DPM Metals Extends Chelopech Mine Life to Ten Years; Provides Updated Mineral Reserve and Resource Estimate and Life of Mine Plan

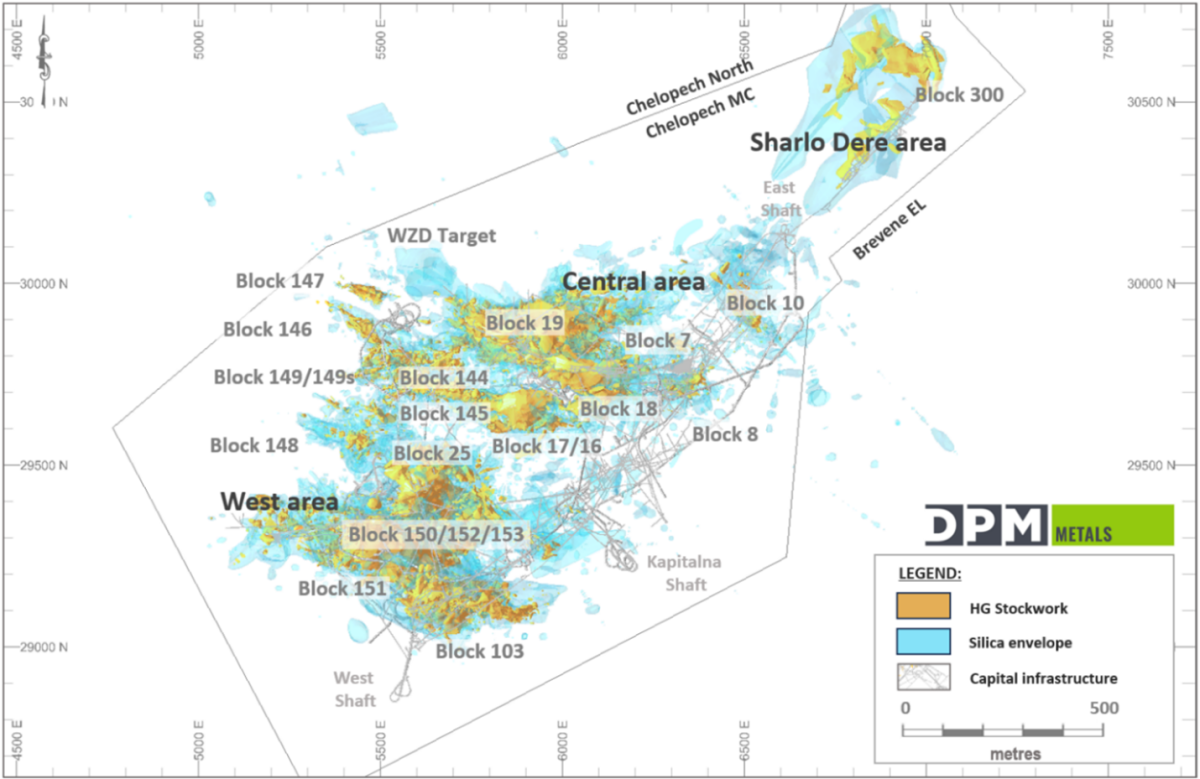

TORONTO, Feb. 05, 2026 (GLOBE NEWSWIRE) -- DPM Metals Inc. (TSX: DPM, ASX: DPM)(ARBN: 689370894) ("DPM” or "the Company”) is pleased to announce an update to the Mineral Resource and Mineral Reserve ("MRMR”) estimate and life of mine ("LOM”) plan for its Chelopech mine in Bulgaria.Highlights(All dollar amounts in this news release are expressed in U.S. dollars, unless otherwise noted.)Mine life extended to 10 years: Based on the updated Mineral Reserve estimate, mine life extends to 2036 for sustained average production levels of approximately 160,000 gold equivalent ounces ("GEO”) per year.1Increased Mineral Reserves: Proven and Probable Mineral Reserves increased to 23.2 million tonnes ("Mt”). Relative to the previous Mineral Reserve estimate, this represents a net increase of 42% in tonnage and increase in metal content of 12% for gold and 10% for copper. The updated Mineral Reserve estimate incorporates the Sharlo Dere prospect, updated model and design parameters as well as updated cut-off calculation assumptions.Mineral Resource base supports additional life extension potential: Measured and Indicated Mineral Resource tonnage, exclusive of Mineral Reserves, increased by 20% to 15.3 Mt, with grades of 1.96 g/t gold and 0.57% copper, in line with Mineral Reserve grades.Attractive value potential from Wedge discovery: The MRMR estimate does not include the Wedge Zone Deep ("WZD”) discovery, located within the northern flank of the Chelopech mine concession and approximately 300 metres below existing Mineral Reserves and current mine infrastructure, or prospectivity of the Chelopech North and Brevene exploration licences. An update on drilling results from WZD is expected in the second quarter of 2026. "Our updated Mineral Reserve estimate, which extends Chelopech’s mine life to 10 years, is a strong indication of Chelopech’s track record of replacing Mineral Reserves, and we believe there is potential to continue this trend going forward,” said David Rae, President and Chief Executive Officer of DPM Metals."We continue to be excited by the Wedge Zone Deep discovery, which underscores the potential at our core operation to add high-grade Mineral Resources within the Chelopech mine concession, extend mine life and enhance long-term value for all stakeholders.”Updated Mineral Reserve and Resource EstimateThe 2025 MRMR estimate reflects updated Mineral Resource estimation parameters as well as updated cut-off calculation assumptions, and is effective as at May 31, 2025. Mineral Resources have been updated to include new geologic information from the Company’s drilling programs, updated modelling and estimation parameters, as well as the addition of the Sharlo Dere prospect (see Figure 1).Updated cut-off assumptions were applied to the Net Smelter Return ("NSR”) calculation, which have been updated to reflect new recovery models based on process plant operational data and updated cost and price information. Figure 1. Plan view of the Chelopech deposit showing the location of key mining blocks as well as the Sharlo Dere Prospect and WZD targetThe Proven and Probable Mineral Reserves increased by 6.9 Mt of ore with contained gold increasing by 174,000 ounces and contained copper increasing by 28 Mlbs. relative to the previous Mineral Reserve estimate as of May 31, 2024.The updated Proven and Probable Mineral Reserve estimate for Chelopech of 1.6 Moz. of gold and 308 Mlbs. of copper supports a mine life that extends to 2036 and sustains production at an average rate of approximately 160,000 GEO2 per year. This does not include the potential for further conversion of existing Mineral Resources and potential additions through ongoing exploration success, including the recent discovery of the WZD target, an area of high-grade mineralization located on the current Chelopech mine concession, adjacent to existing Mineral Reserves.The Sharlo Dere prospect includes a Mineral Reserve inventory of 650,000 tonnes at a grade of 1.49 g/t gold and 0.52% copper. DPM has progressively developed the Sharlo Dere prospect by way of inclined surface diamond drill testing, which has been tested to an approximate 30-metre by 30-metre drill spacing. The prospect has analogous metallurgical characteristics to the main mining areas and metallurgical testing has confirmed it is amenable to the Chelopech flowsheet. The prospective trend at Share Dere extends beyond the Chelopech mine concession, onto the adjacent Chelopech North Concession, which is expected to be granted in 2026.The updated Mineral Reserves estimate is shown below:Chelopech Mine Mineral Reserve Estimate(As of May 31, 2025)ClassificationTonnes (Kt)GradeMetal ContentAu (g/t)Ag (g/t)Cu (%)Au (Koz.)Ag (Koz.)Cu (Mlbs.)Proven6,9772.146.220.614791,39694.57Probable16,2322.209.270.601,1494,836213.81Total 23,2092.188.350.601,6286,231308.38The Mineral Reserves disclosed herein have been estimated in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014). Mineral Reserves has been depleted for mining as of May 31, 2025. The Inferred Mineral Resources do not contribute to the financial performance of the project and are treated in the same way as waste. The reference point at which the Mineral Reserves are defined is where the ore is delivered to the crusher. Long-term metal prices assumed for the evaluation of the Mineral Reserves are $2,300/oz for gold, $23.00/oz for silver, and $3.50/lb for copper. Mineral Reserves are based on an NSR-less-costs cut-off value of $0/t. The total cost applied was approximately $61/t which is a sum of operational costs of approximately $53/t and sustaining capital of approximately $7/t. All blocks include an NSR formula that differentiates the main mineralization types. The NSR formula utilises long term metal price, metallurgical recoveries, payability terms, treatment charges, refining charges, penalty charges (deleterious arsenic), concentrate transport costs, and royalties.Mineral Reserves account for unplanned mining dilution and ore loss by orebody dimension and experience per mining block area. The average values are 6.9% for unplanned ore loss and 7.4% for unplanned dilution. Mineral Reserves account for planned mining dilution and mining recovery through stope optimisation and stope design. The stopes are optimised to maximise net cashflow within the constraints of dilution and orebody extractable geometry. The planned dilution and recovery alter depending on geotechnical, mineralisation continuity controls and ore zone dimensions. All stopes have been verified that they are profitable after the application of the cost of capital development. There is no known likely value of mining, metallurgical, infrastructure, permitting or other relevant factors that could materially affect the estimate. The final seven years of operation occurs after the termination of the mining concession agreement. It is the opinion of DPM that the mining permit will be extended. The Proven Mineral Reserve includes broken stocks of 42 Kt at 1.73 g/t Au, 4.25 g/t Ag and 0.41% Cu as well as stockpiles of 8 Kt at 2.84 g/t Au, 5.75 g/t Ag and 0.68% Cu. Sum of individual values may not equal due to rounding. Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, show a net increase of 2.6 Mt, and a decrease of 52,000 ounces of gold and 29 Mlbs. of copper relative to the 2024 Mineral Resource estimate. The decrease was largely a result of conversion of Mineral Resources to Mineral Reserves as well as the updated cut-off calculation assumptions.Further to this, Inferred Mineral Resources increased by 6.2 Mt containing 333,000 ounces of gold and 65 Mlbs. of copper relative to the previous estimate. This is a result of the updated cut-off calculation assumptions as well as the downgrading of a portion of the Mineral Resource in the upper levels of the mine, based on updated modelling of historically mined areas. Further drilling is planned to determine the extents of these mineralized zones and to determine the geotechnical conditions around the historic mining areas.The Mineral Resource estimate, reported exclusive of Mineral Reserves, is shown below and is effective as at May 31, 2025:Chelopech Mineral Resource Estimate (As of May 31, 2025)Resource CategoryTonnes (Mt)GradesMetal ContentAu (g/t)Ag (g/t)Cu (%)Au (Moz.)Ag (Moz.)Cu (Mlbs.)Measured8.12.328.050.720.6042.096129Indicated7.22.0310.470.560.4702.42489Total Measured and Indicated 15.32.189.190.641.0724.521216Inferred9.11.969.380.570.5732.744114The Mineral Resources disclosed herein have been estimated in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014). Tonnages are rounded to the nearest 0.1 Mt to reflect that this is an estimate. Metal content is rounded to the nearest 1 thousand ounces or 1 Mlbs. to reflect that this is an estimate. The Mineral Resources are reported exclusive of Mineral Reserves. Long-term metal prices assumed for the evaluation of the Mineral Resources are $2,500/oz for gold, $26.00/oz for silver, and $3.85/lb for copper. Mineral Resources are based on a NSR-less-costs cut-off value of $0/t in support of reasonable prospects of eventual economic extraction. It is on average $61/t which is a sum of operational costs of approximately $53/t and sustaining capital of approximately $7/t. All blocks include an NSR formula that differentiates the main mineralization types. The NSR formula utilizes long term metal price, metallurgical recoveries, payability terms. treatment charges, refining charges, penalty charges, concentrate transport costs, and royalties. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.Sum of individual values may not equal due to rounding.Life of Mine PlanThe following table outlines the updated LOM plan, reflecting the updated Mineral Reserve estimate. After testing a range of different scheduling scenarios, the selected plan best meets production goals and optimizes net asset value by maintaining a 2.2 Mt per year mining rate through to 2032, optimized within development rate constraints.This LOM plan will be the basis for DPM’s 2026 guidance and updated three-year outlook, to be announced on February 10, 2026, along with the Company’s fourth quarter and year-end 2025 financial results.For comparison, the current LOM plan, as well as the 2022 LOM plan, are illustrated below:Current Life of Mine Plan1MetricUnit20262027202820292030203120322033203420352036Total /averageOre processedMt2.22.22.22.22.22.22.22.02.01.80.721.9Grade Aug/t2.632.932.192.092.011.751.971.91.861.831.722.11 Cu%0.790.650.640.60.540.60.550.530.520.480.480.59 Agg/t7.29.47.06.07.410.411.311.19.36.34.68.4RecoveriesCopper Concentrate Au%65.157.860.558.551.76664.961.752.251.158.959.2 Cu%85.679.783.583.279.383.981.179.677.878.283.181.6 Ag%48.239.844.443.937.943.440.238.736.438.244.641.0Pyrite Concentrate Au%20.321.923.325.429.21410.911.324.628.424.321.1Production AuKoz.15916513012411599106899284301,193 Cu2Mlbs.332526242124211918156231 Ag3Koz.247265220187198319322276217138432,432Total GEO4Koz.205206175169154146148126126113411,609 Previous Life of Mine PlanMetricUnit20262027202820292030203120322033203420352036Total /averageOre processedMt2.12.121.81.81.81.2----12.7Grade Aug/t2.873.042.82.692.472.582.38----2.72Cu%0.910.70.750.740.720.770.76----0.77Agg/t8.528.339.517.947.598.1111.3----8.62RecoveriesCopper Concentrate Au%57.152.854.355.556.563.163----56.8Cu%84.981.883.383.784.487.186.7----84.4Ag%50.44548.348.349.355.556.8----50.2Pyrite Concentrate Au%24.727.42726.325.6