Gold pares losses after Goldman raises year-end price forecast

Goldman Sachs lifts its year-end gold price forecast to $5,400 an ounce from a previous estimate of $4,900, citing intensifying demand from private investors and central banks

Goldman Sachs lifts its year-end gold price forecast to $5,400 an ounce from a previous estimate of $4,900, citing intensifying demand from private investors and central banks

LOS ANGELES, Jan. 22, 2026 /PRNewswire/ -- Barkev's Inc., a Los Angeles–based fine jewelry brand known for its distinctive engagement rings and modern craftsmanship, announces the launch of its 18K Gold Vermeil Jewelry collection, expanding its assortment in response to shifting gold...

BNY Melon has launched tokenized bank deposits to enable 24/7 on-chain settlement without changing regulation, compliance, or bank liability.

X Starterpacks represents the company’s latest effort to streamline following, accelerate relevance, and boost retention on the platform....The post How X Starterpacks, a platform-curated follow lists could reshape discovery and audience growth first appeared on Technext.

Bitcoin's onchain data shows persistent overhead supply and fragile conviction as the market consolidates below $90,000, Glassnode says.

Video: Gold technical analysis on the 4-hour chartGold prices saw heightened volatility following Donald Trump’s speech at the World Economic Forum in Davos, with risk sentiment briefly shifting toward risk-on after Trump explicitly ruled out the use of military force in the Greenland discussion.This article is a follow-up to our previous gold technical analysis on investingLive, revisiting the same technical structure and explaining why gold’s pullback fits cleanly within a broader bullish framework. You can also see the Nasdaq technical analysis today.Big picture on Nasdaq Technical Analysis Today: the same channel, respected againFrom a technical standpoint, nothing has changed structurally.Gold remains inside the same rising channel previously highlighted, with multiple clean touch points confirming its validity. The internal channel and the key dotted level near 4,760–4,762 remain central to the analysis.Prior analysis referenced 4,760Actual reaction low printed at 4,757.1The deviation was less than 1%, technically negligible relative to the moveThis was a textbook retest, not a breakdown.The 4,760 junction on Nasdaq Futures: a decision point, not a predictionAt the time of the prior article, this area was clearly defined as a junction, meaning:It could trigger profit-takingIt could break higher and trap shortsOr it could briefly dip and then recoverThat is exactly what unfolded.On a lower timeframe, price did reject the level, which allowed for a tactical short trade. That trade was shared in real time on the Investing Live Stocks Telegram channel, where:Partial profits were taken quicklyStops were adjusted to breakevenRisk was neutralized even if the remainder was stoppedThis is a classic example of professional trade management, where execution matters more than direction.The bearish-looking pattern that failed Nasdaq bearsFollowing the initial pullback, price formed a pattern that most participants interpret as bearish. This is important.When a widely watched bearish pattern:Fails to follow throughBreaks to the upside insteadThe result is often accelerated upside, driven by trapped positioning.That is what happened next.Gold surged to 4,891.1, forcing remaining shorts to cover at progressively worse prices.Trump, Greenland, and the risk-on impulseThe next catalyst came from the macro side.When Trump stated he would not use military force regarding Greenland, markets briefly flipped into risk-on mode:Equities pushed higherGold saw a pullbackTechnically, that pullback was near-perfect.The low again tested 4,757Price respected the upper boundary of the channelSubsequent candles showed clean touch points and continuation higherThis is exactly how healthy trends behave.What the price action at Nasdaq futures is signaling nowFrom a technical perspective:The structure remains bullishPullbacks are corrective, not impulsiveBuyers continue to defend the channelIt is entirely possible to see:Another brief retest within the channelAdditional consolidation near resistanceBut based on current price behavior, a retest of all-time highs remains the dominant scenario, unless the channel is decisively broken.Why this matters for Nasdaq traders and investors todayThis move in gold is not about guessing headlines. It is about:Identifying key junctionsWatching price reactionManaging risk dynamicallyGold’s reaction to the Davos headlines did not invalidate the trend. It confirmed it.Today's Nasdaq Futures Key levels to keep in focus4,760–4,762: Major structural support and decision zoneChannel upper boundary: Ongoing resistance and validation area4,891: Recent swing high and reference for continuationGold’s pullback after Trump’s Davos speech was orderly, technical, and constructive. The market respected every major level that mattered, and price action continues to support the bullish structure.As always, these are opinions, not promises. Markets move through reactions at key levels, not certainties.For more updates, charts, and trade management insights, visit investingLive.com.Trade and invest at your own risk.Visit investingLive.com for more about stocks, crypto, forex, commodities, trading and investing education or our onging daily live feed for traders and investors. This article was written by Itai Levitan at investinglive.com.

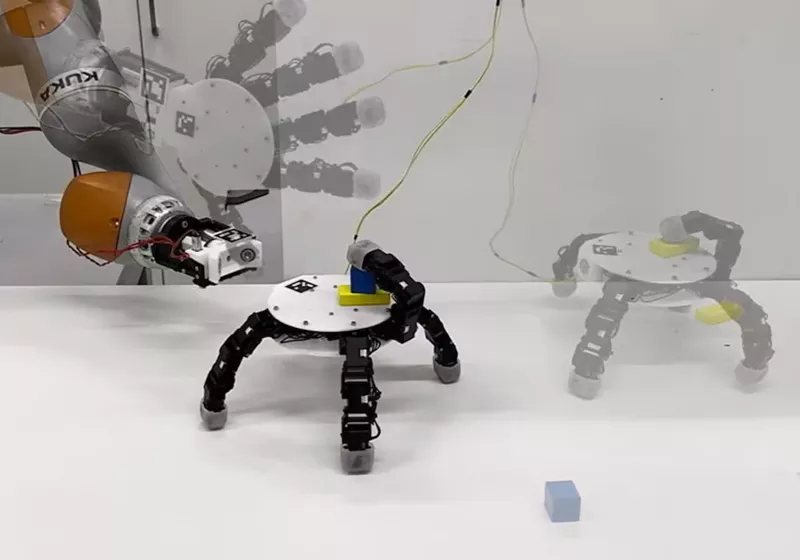

Unlike traditional robotic grippers fixed to stationary arms, this dual-mode manipulator functions both as a conventional end effector and as an independent mobile tool. Once undocked, it can navigate toward objects on its own, using a coordination system that lets each digit crawl and reorient in multiple directions.Read Entire Article

Prabowo's meeting with Starmer resulted in a partnership agreement in the maritime sector, as well as a collaboration in the construction of 1,582 fishing boats in Indonesia.

Shravan Gupta has long believed that progress in real estate comes from adapting to changing lifestyles. As a forward-thinking leader,

Jaipur, Jan 22 (PTI) India is losing waste recycling business opportunities worth thousands of crores due to poor processing capacity

Watch the final live stream of interstellar comet 3I/ATLAS on 22 January 2026. Join the Virtual Telescope Project to see this rare visitor exit our Solar System forever.