Financial News

Pakistan plans $2 billion tokenisation of domestic debt in first phase, advisor says

Proposal unveiled at ITCN Asia aims to tap retail investors and modernise government bond marketsThe post Pakistan plans $2 billion tokenisation of domestic debt in first phase, advisor says appeared first on Profit by Pakistan Today.

The ups and downs of tokenisation

Asset tokenisation is clearly gaining popularity in Pakistan. Already, Pakistan’s Finance Ministry has signed a non-binding memorandum of understanding with the global crypto giant Binance for consultations on the tokenisation of sovereign bonds, treasury bills, and commodity reserves valued up to $2 billion.Separately, Pakistan’s Virtual Assets Regulatory Authority has also granted No Objection Certificates to Binance and HTX to begin local licensing processes. With an estimated 30–40 million Pakistanis actively using digital assets, the government has been increasingly positioning blockchain as a key element in its quest for financial transformation.In simple words, asset tokenisation is the process of turning a physical or financial asset into its digital copies, or tokens, that can then be traded or owned in a blockchain network. One of the main benefits of tokenisation is that it allows the fractionalisation or breakup of non-fungible or indivisible assets into smaller, affordable parts. This, in turn, effectively allows more than one person to own a single expensive asset.Consequently, tokenisation has the potential to democratise access to markets such as real estate, art, private equity, or bonds that have long been closed off to common individuals. This could prove to be helpful in developing countries like Pakistan, where much of the population is poor and has limited access to conventional financial services.Despite their potential to democratise access to markets such as real estate, art, private equity, or bonds, the programmability of NFTs makes them harder to monitor and mitigate potential risksAnother key trait of tokenisation is that the underlying blockchain-based technology has the capability to automate many financial processes, greatly cutting down the need for intermediaries and middlemen like brokers and banks. This allows for near-instant settlement of transactions, greatly increasing efficiency and accuracy, streamlining operations and cutting down costs, and allowing 24/7 trading.Other than that, blockchain’s feature of a shared system of record that cannot be altered allows for greater data security and transparency. It establishes trust in the market and allows for easier oversight and compliance for regulatory authorities. Specifically, such a level of transparency greatly reduces information asymmetry commonly seen in Pakistani markets, allowing participants to operate in an environment where there is a clearer understanding of the risks and returns involved, thereby promoting greater financial inclusion.Above all, asset tokenisation will give rise to a new set of financial products. By turning illiquid assets such as an airplane or machinery, for example, into digital tokens, businesses and governments can generate new sources of funding. However, these assets bring their own set of challenges; chief among them being the lack of understanding of what tokenisation exactly is. The mechanism of tokenising assets is complex, and the products created from it could prove to be even more so. This was particularly true for nonprogrammable assets during the 2008–09 financial crisis, which had been spurred by products that no regulator or inventor understood.The case here is similar, where a layer of programmability complicates the landscape and makes it harder for authorities and investors alike to monitor and mitigate potential risks. Integrating it into the current landscape could also prove to be tricky since there is limited interoperability between blockchain networks and legacy systems. All this requires is a legal and financial framework and expertise that needs to be standardised and implemented across markets and countries.Then there is the issue of the cold start problem. While tokenised assets and products are easy to produce, limited liquidity deters investors from participating in such markets. Overcoming the cold start problem would require constructing a use case in which the digital representation of collateral delivers material benefits — including much greater mobility, faster settlement, and more liquidity. Delivering true, sustained long-term value requires coordination across a multifaceted value chain and widespread engagement of participants with the new digital asset class.The speed of settlements could also prove to be a double-edged sword. Like crypto, tokenised assets, especially those exchanged in secondary markets, could experience significant price volatility. Last of all, a common problem that Pakistan will especially encounter is the security risks that such tokens pose. While blockchain technology is generally considered to be secure, there have been instances of successful cyberattacks on crypto exchanges and other blockchain-based systems.Yet, despite these challenges, tokenisation has the potential to transform the future of finance. The main aim now is to ensure successful adoption while reducing the number of unbanked citizens in the process. By leveraging the benefits of blockchain technology, tokenisation promises the possibility of greater efficiency, transparency, and inclusivity in the financial markets and beyond.The writer is a digital transformation analyst.Published in Dawn, The Business and Finance Weekly, January 19th, 2026

China’s economy grows 5% in 2025, buoyed by strong exports despite Trump’s tariffs

HONG KONG, China — China’s economy expanded at a 5-percent annual pace in 2025, buoyed by strong exports despite Trump’s tariffs. However, growth slowed to a 4.5-percent rate in the last quarter of the year, the government said Monday. READ: China’s exports grew 5.9% in Nov; US shipments dropped 29% That was the slowest quarterly

Oppo counters rising memory prices with feature upgrades in A6 series - digitimes

Oppo counters rising memory prices with feature upgrades in A6 series digitimesOPPO A6s 5G - Large Battery, 80W SUPERVOOC Charge | OPPO Global OPPOAn unstoppable beast with a 7,000 mAh battery and the highest IP69 resistance standard Računalniške noviceOPPO A6t Pro, A6t, and A6t 5G now official YugaTechOppo A6 4G and A6 5G introduced - GSMArena.com news GSMArena.com

GCC Countries Alzheimers Disease Patients Market Witnesses Strong Growth Dynamics with 9.5% CAGR

New Jersey, US State: "The global GCC Countries Alzheimers Disease Patients market in the Consumer Goods and Retail category is projected to reach USD 2.5 billion by 2031, growing at a CAGR of 9.5% from 2025 to 2031. With rising

Asia mixed after Chinese economic data

Stock markets in Asia traded mixed on Monday following a batch of key economic reports from China. The Chinese economy grew by 4.5% in the fourth quarter, less than expected. Its industrial production...

One Month Later, CBS Airs Postponed ‘60 Minutes’ Report With Few Changes

A 13-minute segment about Venezuelan men deported by the Trump administration had been pulled at the last minute by CBS News’s editor in chief, Bari Weiss.

China's unemployment rate at 5.1% in December

China's urban surveyed unemployment rate came in at 5.1% in December, unchanged from the previous month's figure, the country's National Bureau of Statistics said on Monday. The rate stood at 5.2% on ...

China’s GDP grows 5 per cent in 2025

Booming exports offset weaker growth in the domestic economy

China’s Q4 GDP growth slows to 3-year low, full-year pace meets official target

Gold hits record high near $4,700/oz on Trump tariff threats over GreenlandBEIJING, Jan 19 (Reuters) - China’s economic growth slowed to a three-year low in the fourth quarter as domestic demand softened, and while the full-year pace hit Beijing’s target, trade tensions and structural imbalances...

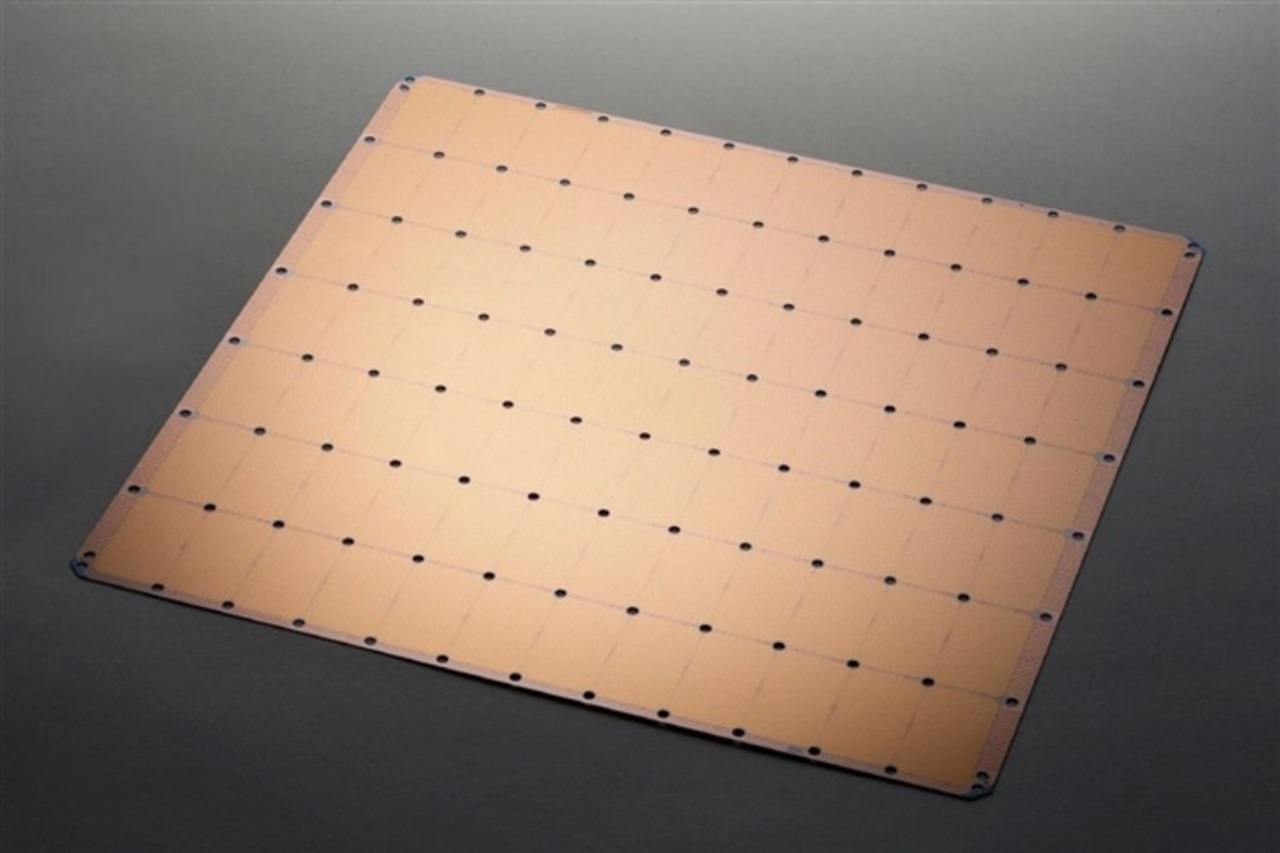

OpenAI taps Cerebras for US$10 billion AI chip buildout

OpenAI said it would partner with the artificial intelligence chip maker Cerebras to build 750 megawatts of ultra-low-latency AI computing capacity, a project that will come online in phases starting in 2026. Construction is expected to begin this year and continue through 2028.