Goodbye, VirtualBox - I found a better, more reliable VM manager for Linux

Virt-Manager is a free and easy-to-install virtual machine manager. Here's how it compares to VirtualBox.

Virt-Manager is a free and easy-to-install virtual machine manager. Here's how it compares to VirtualBox.

Ethereum has slipped below the $3,000 level again as selling pressure returns across the broader crypto market, keeping bulls on the defensive after a brief recovery attempt. The move back under this psychological zone suggests that traders remain cautious, with downside volatility re-emerging as risk appetite fades and liquidity thins near key support levels. Related Reading: Binance Order Flow Suggests Ethereum Is In Correction Mode: Demand Still Missing However, while price action looks heavy in the short term, on-chain data is flashing a different signal beneath the surface. According to Arab Chain, Ethereum reserves held across centralized exchanges have dropped to around 16.2 million ETH, marking their lowest level since 2016. That milestone matters because it highlights a steady, long-duration trend of withdrawals rather than a sudden one-off event. In practical terms, fewer coins sitting on exchanges typically means less immediate supply available for spot selling, especially during periods of market stress. This behavior can reflect a shift away from short-term trading and toward longer-term holding, self-custody, or deployment in DeFi. Ethereum remains vulnerable as price struggles below $3,000. Still, the persistent reserve decline suggests that supply conditions may be tightening in the background, setting the stage for a sharper reaction if demand returns. Binance Reserves Keep Falling The CryptoQuant analysis also points to a similar reserve drawdown on Binance, reinforcing the broader exchange supply contraction narrative. Since the beginning of 2026, Binance’s Ethereum reserves have dropped from roughly 4.168 million ETH to around 4.0 million ETH, signaling steady withdrawals even as the price remains under pressure. This matters because Binance is often the main liquidity hub for ETH spot and derivatives, so shifts in its reserve balance can reflect real changes in market positioning. What stands out is that this decline is happening without a meaningful rebound in inflows. In other words, ETH is not rotating back onto exchanges aggressively, suggesting sellers are not rushing to increase liquid supply at current levels. That dynamic typically aligns with a market where investors prefer holding behavior over active distribution. Either moving ETH to cold storage or deploying it across DeFi. While reserves falling does not guarantee an immediate rally, it can change the supply-demand equation over time. With fewer coins sitting on exchanges, the market becomes more reactive if demand returns suddenly, as there is less readily available ETH to absorb buy pressure. If Ethereum manages to reclaim key resistance levels, this supply tightening could amplify upside follow-through. Related Reading: XRP Leverage Builds Without Overheating: Open Interest Climbs And Volatility Spikes Ethereum Loses $3,000 as Bears Regain Control Ethereum is showing renewed weakness after failing to hold above the key $3,000 level, with price now hovering near $2,970 on the daily chart. After briefly stabilizing earlier this month, ETH attempted a rebound toward the $3,300–$3,400 supply zone. But momentum faded quickly as sellers stepped back in and pushed the market lower. From a technical perspective, Ethereum remains trapped below its major moving averages, reinforcing the bearish structure. The recent rejection near the descending trend of the 200-day average signals that upside attempts are still being capped by overhead resistance. Keeping bulls on the defensive. At the same time, the breakdown below $3,000 shifts market sentiment back into risk-off mode. Especially as crypto traders remain sensitive to broader macro uncertainty. Related Reading: Trade War Headlines Trigger $800M In Liquidations Overnight: Longs Get Wiped Out Across Crypto Markets The current price action also reflects a fragile recovery attempt rather than a confirmed reversal. ETH’s latest drop places focus on the $2,850–$2,900 region as the next support area. An area where buyers previously stepped in during earlier selloffs. If this zone fails to hold, the market could revisit deeper levels from the previous correction phase. For bulls to regain control, Ethereum must reclaim $3,000 quickly and build stronger demand above that threshold.

Get ready for exciting new travel possibilities as American Airlines unveils its 2026 plans.

In a large study, almost 27.3% individuals reported they had some type of sleep disorder.

KARACHI: A whopping jump of $127 per ounce in the international market to $4,840 per ounce pushed the domestic gold (24 karat) rate to Rs506,362 per tola on Wednesday, the highest in the country’s history, after an increase of Rs12,700 per tola from Tuesday’s price.The record-high rate has added to the burden on gold jewellery buyers during the ongoing peak wedding season, while investors appear upbeat over the sharp rally triggered by geopolitical tensions, ongoing tariff wars and US President Donald Trump’s efforts to control Greenland.According to rates issued by the All Pakistan Sarafa Gems and Jewellers Association (APSGJA), based on interbank exchange rates, the domestic 10-gram gold rate rose to Rs434,123, up by Rs10,888 from Tuesday.On Jan 1, the 10-gram and one-tola gold rates stood at Rs234,568 and Rs273,600, respectively, based on the global gold rate of $2,624 per ounce. To date, prices of 10-gram and one-tola gold have surged by Rs199,555 and Rs232,762, respectively, while the international price has climbed by $2,216 per ounce.Gold currently leads in terms of returns among select asset classes, with stocks in second place.It has been observed that local gold prices have shown wide disparities in the past between the official rates announced by the association and open market rates prevailing at jewellery shops. However, on Wednesday, jewellers were offering gold at Rs503,000-505,500 per tola, lower than the association’s rate of Rs506,362.“The price difference between the association and market rates depends on demand and supply,” APSGJA President Qasim Shikarpuri said, adding that investors were currently driving the gold market rather than jewellery buyers.“Investors all over the world and in Pakistan are selling dollars to buy gold,” he said, adding that central banks in various countries were also making large purchases of the yellow metal.He said there was no shortage of gold in the market despite heavy investor interest, claiming that the per-tola gold rate in Pakistan was selling under cost by Rs25,000 compared to rates in Dubai.SilverIn contrast, investors are also active in purchasing silver, which is currently in short supply due to high demand and is available at a hefty premium.The one-tola silver (24 karat) rate rose to Rs9,933, up by Rs64 per ounce, while the 10-gram rate climbed to Rs8,515, up by Rs54 per ounce, in line with a slight increase in the world silver price to $94.58 per ounce, up by $0.64.“Silver is available at Rs14,500 instead of Rs9,933 per tola due to huge demand coupled with its shortage in the market, not only in Pakistan but also in Dubai,” Mr Shikarpuri said, adding that speculation was underway in the silver market.Meanwhile, All Karachi Jewellers and Manufacturers Association President Mohammad Haseen Qureishi recalled that silver was not available at Rs15,000 per tola on Tuesday, while on Wednesday its price was hovering between Rs13,500 and Rs14,000, depending on availability.Published in Dawn, January 22nd, 2026

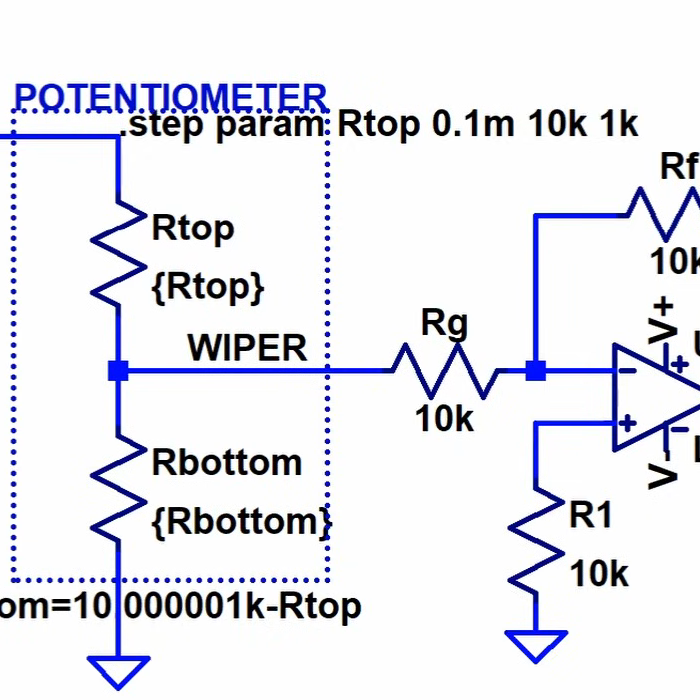

One of the good things about simulating circuits is that you can easily change component values trivially. In the real world, you might use a potentiometer or a pot to ...read more

One shot might make you hot, but is it accurate?

President Donald Trump said he would ask Congress to implement his proposal to cap credit card interest rates at 10% for one year, a policy that’s drawn pushback from some of the biggest banks and card issuers.

China has issued the first batch of 93.6 billion yuan ($13.44 billion) of ultra-long-term special treasury bonds to support equipment upgrades for this year, the state planner said on Thursday, as part of steps to shore up the economy.

The Japanese Yen (JPY) is seen oscillating in a narrow trading band against its American counterpart during the Asian session on Thursday amid mixed fundamental cues.

Davos (Switzerland), January 22 (ANI): Founder of Lulu Mall, Yusuf Ali, stated that all Indian products can now enter duty-free and vice versa, owing to the signing of the Comprehensive Economic Partnership Agreement (CEPA) at the 56th Annual Meeting of the World Economic Forum (WEF) in Davos. Speaking to ANI at the Business Summit, Ali said that the agreement will create effective trading opportunities for Indi

Stocks track Wall St rally as Trump cools tariff threats in Davos