How to file your taxes for free in 2026 - 4 ways to do it (despite Direct File's demise)

The IRS's Direct File Service is no more, but most taxpayers can use one of these free options to prepare their 2025 returns - even if you itemize deductions.

The IRS's Direct File Service is no more, but most taxpayers can use one of these free options to prepare their 2025 returns - even if you itemize deductions.

Bitcoin is hovering at a critical demand zone as the market braces for the possibility of further downside. After losing the $87,000 level, price action remains fragile, with buyers struggling to regain control and sell-side pressure intensifying during rebounds. The broader risk-off mood frames the latest drop as a response to growing macro uncertainty rather than a purely technical move. Related Reading: Bitcoin Indicator Falls Back To Post-Bear Market Levels: Investors Approach A Key Decision Point Rising political instability in the United States appears to have acted as the near-term trigger. Prediction markets now place the probability of a new government shutdown at roughly 78%, with federal funding set to expire on January 30, 2026. As bipartisan negotiations stall, political risk is once again being priced into markets, weighing on sentiment and pushing traders toward defensive positioning. In this environment, Bitcoin broke below $87,000 and sparked a fast liquidation cascade. Data shows that around $170 million in leveraged long positions were wiped out within 60 minutes, with total long liquidations reaching roughly $320 million over the following four hours. Nearly $40 billion in total crypto market value vanished in a short span, highlighting how quickly volatility can expand when liquidity is thin. The speed and structure of the move suggest a derivatives-driven deleveraging event rather than broad spot capitulation. That distinction matters because it implies the next phase will depend on whether forced selling fades and real demand returns at this level. Liquidations And OI Reveal A Deleveraging-Led Drop A report from XWIN Research Japan explains that Bitcoin’s latest flush was likely amplified by a wave of forced liquidations in the derivatives market. Liquidations occur when futures positions fall below their maintenance margin and are automatically closed by exchanges to prevent further losses. In this case, a large share of the risk was concentrated in leveraged long positions, which are commonly used by short-term traders as well as hedging and arbitrage participants. Many of these longs were positioned for a renewed 2026 uptrend, making the market vulnerable once the price slipped under key support. When the decline accelerated, liquidation orders hit the books as market sells. Which can intensify downside moves in thin liquidity environments. To understand whether this was a structural shift or simply a leverage reset, XWIN points to Open Interest (OI). OI measures the total size of outstanding futures contracts and reflects how much leverage remains embedded in the market. When price falls alongside declining OI, it typically signals that position unwinds and liquidations are driving the move rather than a sudden change in fundamentals. On-chain estimates place aggregate OI near $28.4 billion. Well below the roughly $47 billion peak in late 2025, showing that leverage had already reduced. Still, OI has stabilized and slightly rebounded in early 2026, leaving room for volatility during corrections. The key is what comes next: whether selling fades, spot demand absorbs supply, and leverage normalizes as participation returns. Related Reading: Bitcoin Stuck In Bear Mode For 83 Days: Trend Pulse Confirms Structural Weakness Bitcoin Slides As Key Moving Averages Turn Into Resistance Bitcoin is trading near $87,820 after a steady decline that has kept the price pinned below $90,000. The structure shows BTC losing momentum after failing to hold the mid-January breakout toward $98,000. Followed by a sharp reversal that shifted market control back to sellers. Since that rejection, price has printed a sequence of lower highs, with selloffs accelerating each time BTC attempts to reclaim overhead levels. From a trend perspective, the moving averages highlight how the short-term regime has flipped bearish. BTC is now trading below the 50-period moving average (blue) near $90,300 and below the 100-period moving average (green) around $91,955, both of which are sloping downward. These levels are now acting as dynamic resistance, reinforcing the idea that traders are selling rallies. The 200-period moving average (red) sits close to $90,756, creating a tight resistance cluster between $90.3K and $92K. Bulls must reclaim this cluster to rebuild momentum. Related Reading: XRP Distribution Phase Continues, But Funding Rates Suggest Shorts Are Overextended Support is developing around the $87K–$88K zone, which has acted as a short-term demand pocket during prior pullbacks. If buyers fail to defend this area, downside risk opens toward $86,000 and potentially the mid-$84K range. BTC needs a clean reclaim of $90K, followed by consolidation above the moving-average band. Signaling that demand is returning with strength. Featured image from ChatGPT, chart from TradingView.com

Data centers are becoming the key lens for understanding the clean tech industry and US politics.

Pine Labs works with banks and enterprises globally to modernise legacy financial infrastructure through modular, cloud-native platformsThe post Wio Bank partners with Pine Labs to build cloud-native acquiring platform appeared first on Gulf Business.

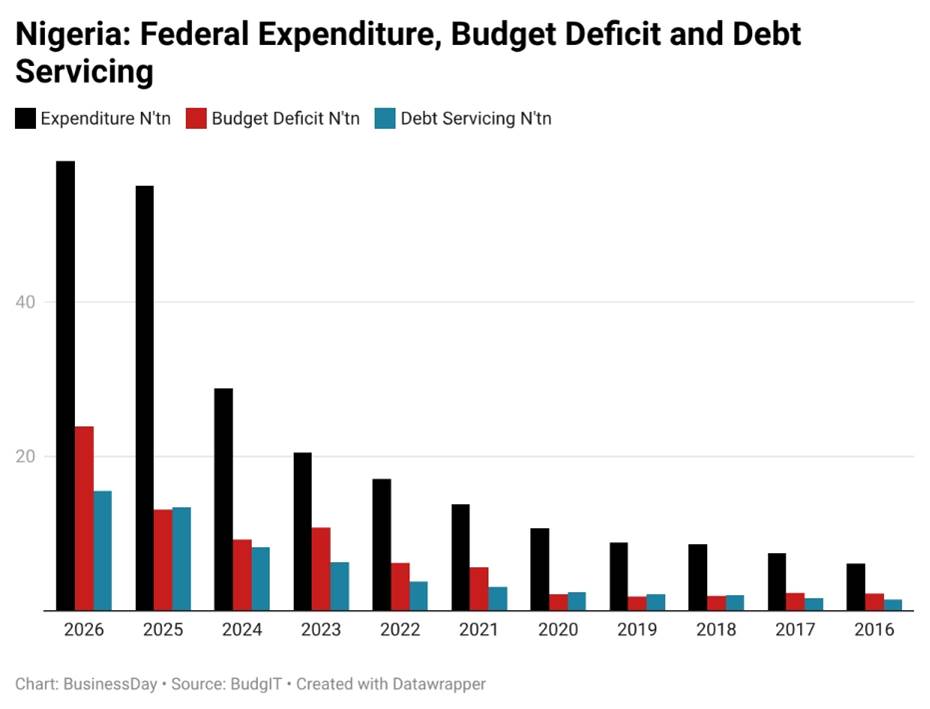

Nigeria has been caught in a borrowing web in the last decade as the budget deficit widened from N2.2 trillionread more Nigeria caught in borrowing web as deficit surges 984% in 11 years

A record-breaking year for F-35 deliveries, but the truth behind the numbers may surprise you.

Kael stood in the Garden of Hydroponics. He was alone. He looked at the man's face. The skin on the left side of the man’s face wasn't skin. It was a roadmap of melted wax.

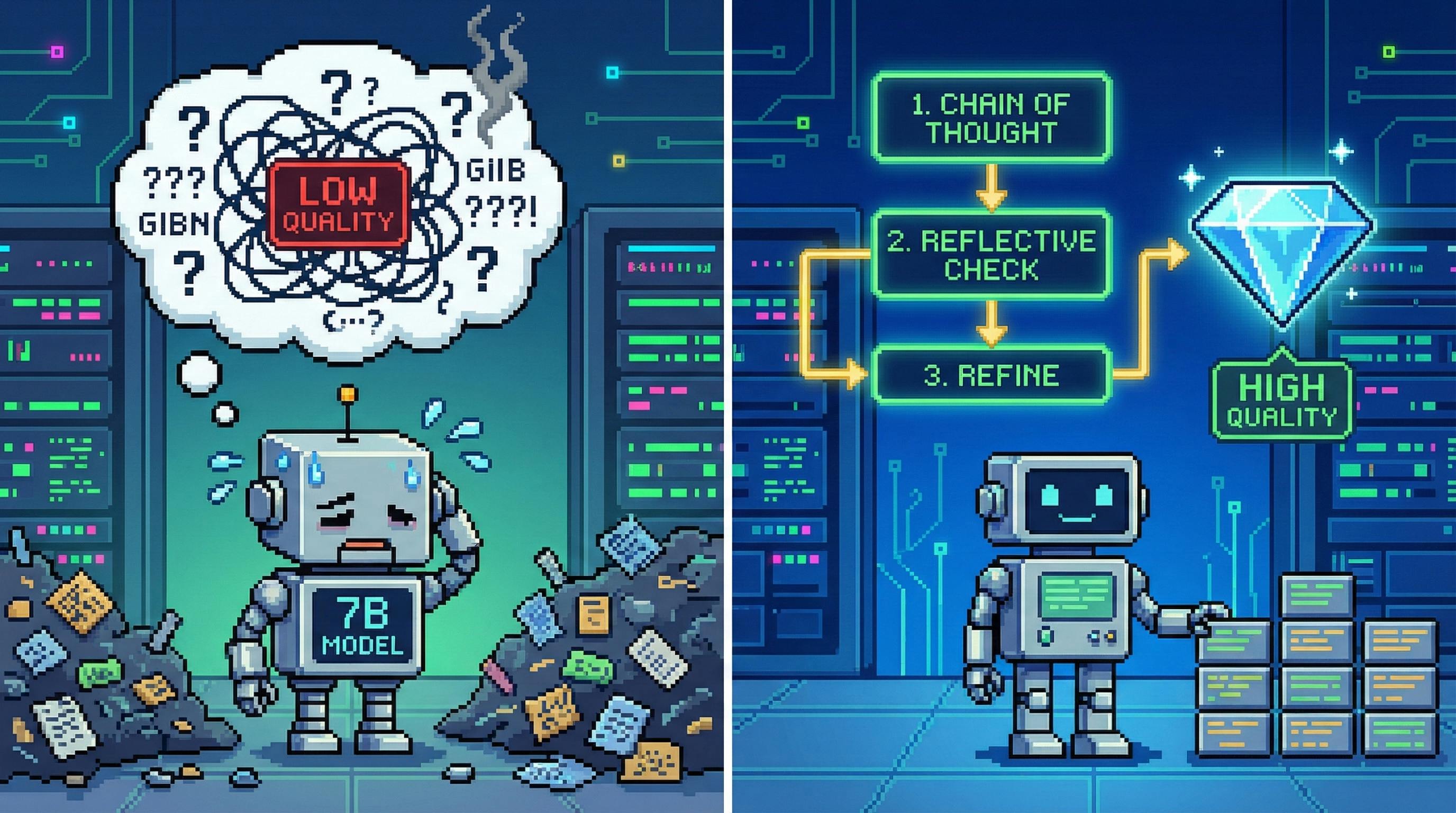

A practical guide to making 7B models behave: constrain outputs, inject missing facts, lock formats, and repair loops.

The vending machine industry is rapidly evolving as businesses look for smarter, more flexible, and more brand-centric ways to sell products. Traditional snack-and-soda machines are no longer enough to meet modern consumer expectations. As a result, companies are increasingly investing

Adelaide, South Australia - HealthQ said that it was launching its full range of professional NDIS compliance, NDIS audit support, NDIS business consultants, and health management consulting [https://www.healthq.com.au/] services for organisations in the health, disability, and human services sectors all

Nigeria's ₦2 billion capital requirement for crypto exchanges is meant to create a stronger crypto ecosystem, but it may end making foreign players stronger and local players weaker.

From exchange utility and mid-cap liquidity to BlockDAG’s $0.001 presale, this breakdown shows where 2026 conviction builds.