forexlive15d ago

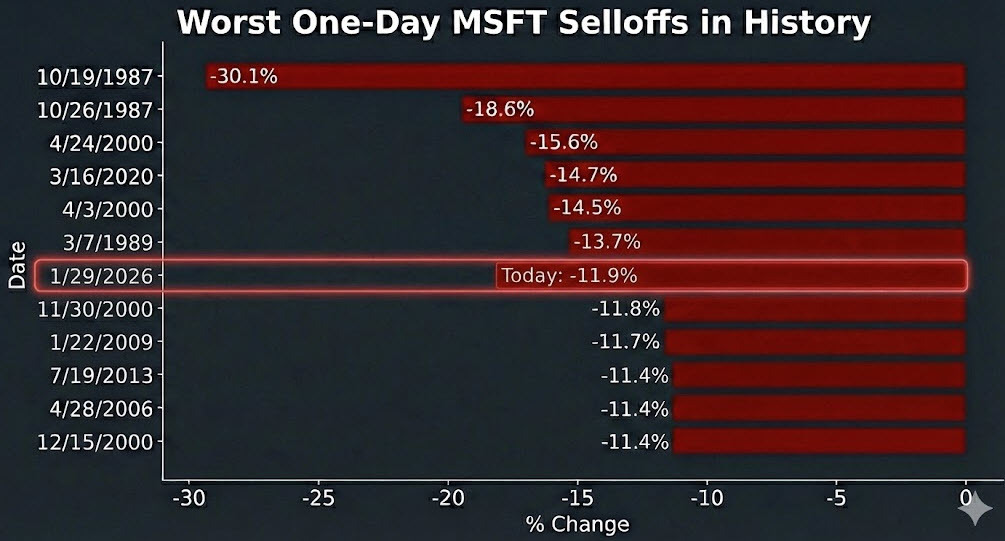

Is OpenAI suddenly toxic?The market is sensing that ChatGPT is going to lose the generative AI race because they can't keep up with the spending of Google and others. Plus they don't have the data and integration of their megacap competitors.Microsoft posted a 24% rise in y/y earnings today but shares are down 11.5%. That makes today the 9th worst day ever for Microsoft stock by by far the largest single-day drop in market cap.In fact, this is the second-largest single day market cap destruction after the Jan 28, 2025 decline in NVDA. Here is the chart of the worst ever days for market cap wipeouts. It doesn't include MSFT stock today but it's down around $400 billion.The company has bet big on OpenAI and the market is questioning the wisdom of that, with new disclosures revealing that OpenAI accounts for 45% of Microsoft's total long-term backlog. This unusually high concentration has raised concerns about Microsoft's exposure to a single partner, especially amidst questions about OpenAI's future funding needs.In the core business, Azure revenue grew by 38–39% (beating guidance slightly) but decelerated compared to the previous quarter (40%) and barely surpassed the high expectations built into the stock price. Analysts at Evercore noted that investors are now demanding "clearer evidence" that the elevated spending is translating into faster growth, which wasn't sufficiently visible in this report.The primary driver of the negative sentiment is the 66% year-over-year jump in capital spending, which hit a record $37.5 billion for the quarter. Investors are spooked by the sheer scale of the spending on AI infrastructure without seeing a proportional acceleration in immediate revenue. The market may also question whether MSFT can execute after the terrible co-pilot rollout.Overall, this isn't a great sign of market sentiment and the AI trade and you can see that in a 2.4% decline in the Nasdaq. This article was written by Adam Button at investinglive.com.