Copper prices touch a record high as metals are going ‘absolutely bonkers’ right now

Prices for gold, copper and other metals are going “absolutely bonkers” right now, says a Marex analyst.

Prices for gold, copper and other metals are going “absolutely bonkers” right now, says a Marex analyst.

For years, the promise of using stablecoins for business has been blocked by one fundamental flaw: a total lack of privacy. Every transaction on a public blockchain is visible to anyone, making them a non-starter for sensitive operations like payroll. Today, that changes.

Volatility returned to Wall Street Thursday, the session after the Federal Reserve meeting, but this time the selloff was less macro-driven and more stock-specific.By midday trading in New York, major tech-heavy indices were sharply lower, weighed down by a historic drop in Microsoft Corp. (NYSE:MSFT) whose outsized index weight amplified losses across benchmarks.Microsoft shares plunged 12%, marking their worst session since March 18, 2020. The stock fell despite beats on earnings and revenue, as investors focused on slowing Azure cloud growth and cautious guidance, with investors now questioning the pace of AI monetization. The selloff erased roughly $400 billion in market capitalization.The S&P 500 dropped 1% to 6,900 points, while the Nasdaq 100 erased 300 points or 1.6%. The Dow Jones and the Russell 2000 were less affected given their relative underweight in tech. Chart: Microsoft On Track For Worst Day Since 2020’s Lockdown ShockMeta Bucks The Trend, Travel Stocks SoarAll members of the Magnificent Seven traded lower, except Meta Platforms (NASDAQ:META) which jumped more than 8% after a strong fourth-quarter beat, upbeat first-quarter revenue guidance and plans for higher capital spending tied to AI and advertising growth.International Business Machines Corp. (NYSE:IBM) climbed 6% after delivering better-than-expected quarterly results and guidance, standing out in an otherwise weak session for large-cap technology stocks.Software-related names suffered heavy declines. ServiceNow Inc. (NYSE:NOW) plunged ...Full story available on Benzinga.com

Market Analysis by covering: US Dollar Japanese Yen, Gold Spot US Dollar, Silver Spot US Dollar, US Dollar Index Futures. Read 's Market Analysis on Investing.com

BitcoinWorldCryptocurrency Futures Liquidated: Staggering $103 Million Hourly Wipeout Signals Market TremorsGlobal cryptocurrency markets experienced a sharp and significant contraction today, with major exchanges reporting a staggering $103 million in futures positions forcibly closed, or liquidated, within a single sixty-minute window. This intense burst of market activity, concentrated in the past hour, forms part of a broader 24-hour liquidation total exceeding $806 million, according to aggregated [...]This post Cryptocurrency Futures Liquidated: Staggering $103 Million Hourly Wipeout Signals Market Tremors first appeared on BitcoinWorld.

Edgeworth police will be adding a new vehicle to its fleet this spring.

Syracuse, NY, Jan. 29, 2026 (GLOBE NEWSWIRE) -- As AI continues to dominate headlines and reshape every aspect of daily life, Owen P. Falco delivers a timely guide with the launch of the Human AI Book Series. The first book, "Top 20 Social Aspects of AI Technology: Artificial Intelligence and Semantic Understanding for Seamless Human-Computer Interaction," has peaked at #1 New Release in Computers and Technology on Amazon. Readers are giving it rave reviews with a 4.8 out of 5 star rating.Top 20 Social Aspects of AI Technology: Artificial Intelligence and AI Semantics for Seamless Human-Computer InteractionWith AI advancing faster than ever—from ChatGPT updates to new workplace tools launching weekly—understanding its impact on our lives has never been more important. Most people know that AI is changing the world. But few understand how it's quietly changing the way we live—our jobs, family talks, friendships, and even what it means to be human."AI isn't just changing technology; it's changing us," says Falco, who specializes in artificial intelligence and how humans interact with computers. "From the social media that shapes what we see every day to the smart assistants we talk to like family members, we're living through a big shift right now. This book helps readers understand what's really happening."More Than ...Full story available on Benzinga.com

Also in this week’s newsletter: Mahmood’s far-reaching police reforms

One-Third of U.S. Video Game Industry Workers Were Laid Off Over the Last Two Years, GDC Study Reveals VarietyGDC survey reveals layoffs up 6%, 36% of industry using AI, and overwhelming support for unionisation in the US GamesIndustry.bizHalf of developers think gen AI is bad for the gaming industry The VergeMore than a quarter of devs surveyed by GDC were laid off in the past two years, and half of them don’t have a new job Video Games ChronicleState of the Game Industry Survey: Game Workers United on Unionization, Divided on Gen AI TechPowerUp

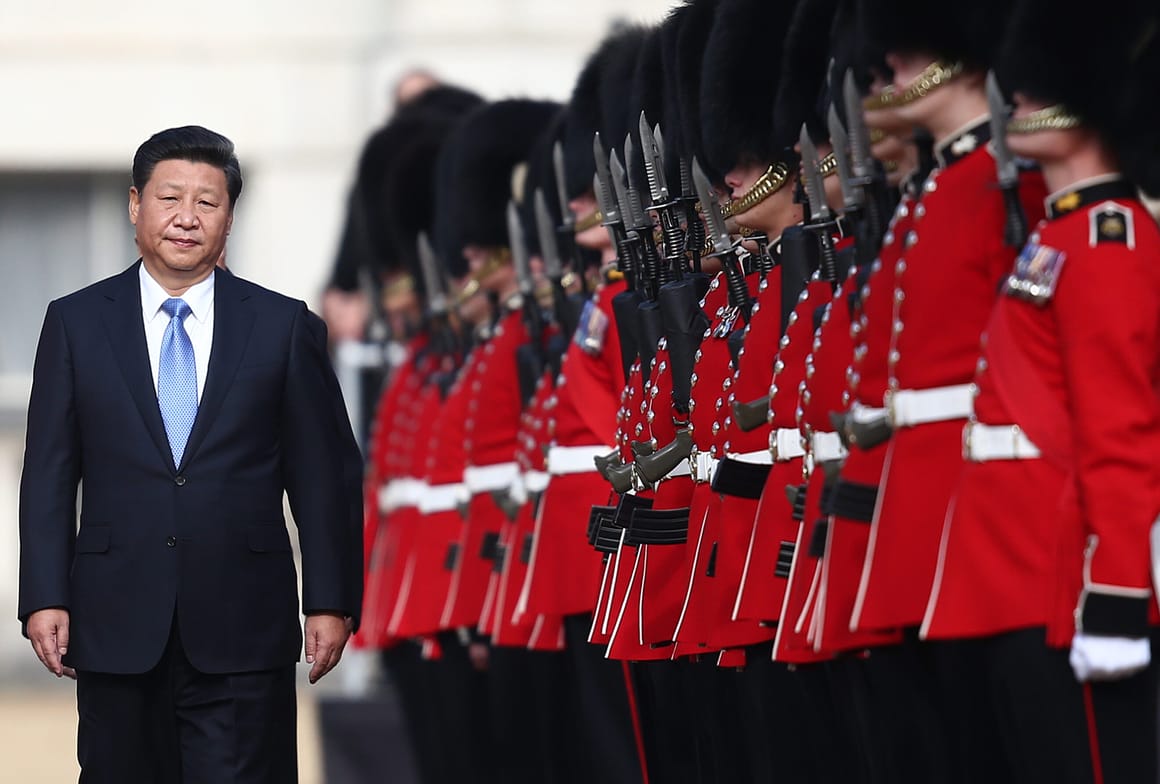

Keir Starmer's China visit is not a "one-and-done summit," Downing Street said.

KeySmart's new dual-network SmartCard works with Apple FindMy and Google Find Hub, so you can track your wallet with any phone.

After months of compressed price action, XRP is back in focus after a widely followed crypto trader on X highlighted a significant shift on the weekly chart. The asset is now showing a technical signal that has historically appeared near major turning points, sparking debate over whether this setup can realistically support a move back toward XRP’s prior all-time highs. XRP’s Multi-Year Range Holds As Bullish Momentum Emerges The crypto trader notes that XRP’s current market structure remains anchored to a clearly defined weekly price range that dates back to the 2018 cycle peak. This long-standing zone, stretching roughly from the low-$2 area to the low-$3 region, has functioned as a structural equilibrium for XRP across multiple market phases. Since late 2024, XRP’s price has stayed compressed within this range, repeatedly testing both support and resistance without delivering a decisive breakout or breakdown. Related Reading: What’s Going On With The US Dollar And How Does It Affect Bitcoin, Ethereum Prices? What differentiates the current setup from previous failures is the behavior of momentum. On recent weekly lows, momentum indicators have begun forming higher lows even as price revisits familiar support levels. In practical terms, downside moves are losing strength, signaling that selling pressure is weakening. This bullish divergence suggests distribution is fading, with sellers expending more effort for diminishing downside results. The chart shared by the trader reinforces this view, showing price holding range support while underlying momentum trends higher. From a structural perspective, this consolidation reflects absorption rather than weakness. Short-term participants are gradually replaced by longer-term holders, improving market stability. While a bullish divergence alone does not guarantee a return to all-time highs, it reopens that discussion in a technically credible way. A sustained breakout above the upper boundary of this multi-year range would be the key confirmation. Until that occurs, ATHs remain a conditional outcome—but the divergence signals that the groundwork for such a move may now be forming. Macro Rotation And The Case For A Delayed Altcoin Catch-Up The broader market context reinforces the significance of the trader’s weekly XRP analysis. Equities continue to reach record highs, metals are losing momentum, and the US dollar is falling—conditions that historically signal capital rotation. Yet, many altcoins, including XRP, remain sidelined in sentiment, largely overlooked after underperforming relative to newer narratives. Related Reading: Bitcoin Price Prediction: Analyst Forecasts 72.86% Crash To $30,000 According to the crypto trader, this disconnect is notable: altcoins still trade well above bear-market lows, but cautious positioning creates the potential for asymmetric gains if capital rotates from crowded trades. The bullish divergence on XRP’s weekly chart does not guarantee an immediate rally or automatic return to all-time highs. However, it signals that structural groundwork for a larger move is forming. If XRP can reclaim and break above the upper boundary of its multi-year range with conviction, the case for revisiting previous peaks becomes materially stronger. This setup reflects temporary frustration, not failure. Momentum is building, and while patience is required, the chart suggests the market is positioning correctly for a potential delayed catch-up in the altcoin sector. Featured image created with Dall.E, chart from Tradingview.com