Kerala To Bhutan For Rs 2,600 Without Visa? Check Budget Trip Details, Train Route, Ticket Price

A 3AC train ticket from Kerala to Bhutan’s nearest railway stations, Hasimara or Alipurduar in West Bengal, costs under Rs 3,000.

A 3AC train ticket from Kerala to Bhutan’s nearest railway stations, Hasimara or Alipurduar in West Bengal, costs under Rs 3,000.

SYDNEY -- Australia and Japan have a history of collaboration on critical minerals, and recent export curbs by Beijing are encouraging the two nations to cooperate even more closely to build an alternative supply chain for the ingredients used in everything from batteries to wind turbines. The...

The crypto market faced a sharp selloff overnight as renewed trade conflict fears between the United States and the European Union shook global risk sentiment. Bitcoin and major altcoins reversed recent gains, with traders reacting to fresh tariff headlines and the possibility of escalating economic retaliation on both sides of the Atlantic. While crypto is often viewed as a separate market, this move once again showed how quickly digital assets can behave like high-beta risk trades when macro uncertainty spikes. Related Reading: Monero Triggers Retail Alert That Preceded ZEC And DASH Drops As Privacy Coin Hype Returns According to analyst Darkfost, the liquidation impact was immediate and aggressive. More than $800 million worth of leveraged positions were wiped out in a matter of hours, including roughly $768 million in long liquidations. The scale of long closures suggests that traders were positioned for continuation to the upside, but were caught offside as prices rolled over sharply. What stood out most was where the damage occurred. Darkfost noted that Hyperliquid recorded the largest share of forced liquidations, with $241 million, while Bybit followed closely with $220 million. The wave of liquidations appears partly tied to the announcement of new tariffs targeting Europe, which triggered an equally fast response from EU policymakers, reigniting the broader “trade war” narrative across markets. CME Opens the Door to Fresh Volatility Darkfost warns that the timing of this selloff matters as much as the liquidation size. As soon as CME trading opened, Bitcoin saw a sharp downside move, suggesting that institutional flows and macro-linked positioning played a direct role in the shakeout. In past risk-off episodes, the CME open has often acted like a volatility trigger, especially when markets are already fragile, and leverage is elevated across major exchanges. This is why the next few hours are critical. The same type of move could easily repeat at the opening of the US markets, where liquidity conditions and headline sensitivity tend to amplify reactions. If sellers press again, the market could see another cascade of forced closures, particularly in high-beta altcoins that remain vulnerable after the overnight wipeout. Related Reading: XRP Whale Inflows To Binance Hit Their Lowest Level Since 2021: Accumulation Behavior? The message is straightforward: stay cautious and avoid overexposure to leverage while the macro backdrop remains unstable. Liquidations can create sharp bounces, but they can also reset momentum quickly if fear spreads across risk assets. Darkfost adds that attention should remain on incoming political updates. The market is now trading the narrative, not just the chart. Further statements could arrive at any moment, and as history has shown, Trump often delivers market-moving headlines right in the middle of the weekend. Bitcoin Holds Fragile Rebound As Crypto Tests Macro Nerves Bitcoin is trading near $93,100 after a sharp rejection from the $96,000–$97,000 supply zone. The chart shows BTC still struggling below key moving averages, with momentum capped by the declining blue trendline overhead. This reinforces the idea that the latest upside attempt was more of a rebound than a clean trend reversal. Structurally, price is forming higher lows after the violent breakdown from the $110,000 area. However, the rebound remains vulnerable as long as BTC stays trapped beneath resistance and fails to reclaim the mid-$90,000s with conviction. The recent candles also highlight hesitation, with wicks suggesting aggressive selling into strength. Related Reading: Bitcoin Bull Score Hits Level Seen Only 7 Times In 6 Years – A Rare Historical Signal The red long-term moving average is rising near the low-$90,000s, acting as a potential dynamic support zone. If Bitcoin holds above that level, it keeps the recovery structure intact and prevents a deeper reset toward prior liquidity pockets. This matters for the broader crypto market. When BTC remains range-bound under resistance, altcoins usually struggle to sustain rallies and become more sensitive to liquidation-driven volatility. Risk appetite can return quickly, but it requires Bitcoin to break above resistance and hold. Until then, crypto remains in a fragile stabilization phase, not a confirmed bullish continuation. Featured image from ChatGPT, chart from TradingView.com

The annual dining promotion features lunch, dinner, and brunch deals at more than 380 DMV-area restaurants, including 35 that are participating for the first time. On average, Restaurant Week menus offer 20-25% off regular prices.According to RAMW and NBC4, restaurants new to Winter Restaurant...

The Golden State Warriors (24-19) ride a historic streak of volume 3-point shooting as they host the Miami Heat (22-20).

Shanghai has laid out a full spectrum of goals on finance for the next five years and beyond, following an unequivocal push by China’s central leadership to grow the city into an international financial centre.China’s largest city-level economy aims to evolve into a world-class, socialist metropolis by 2035, with an intensified focus on innovation and manufacturing, according to a local document released on Monday.Shanghai unveiled its proposals for the drafting of its own 15th five-year plan,...

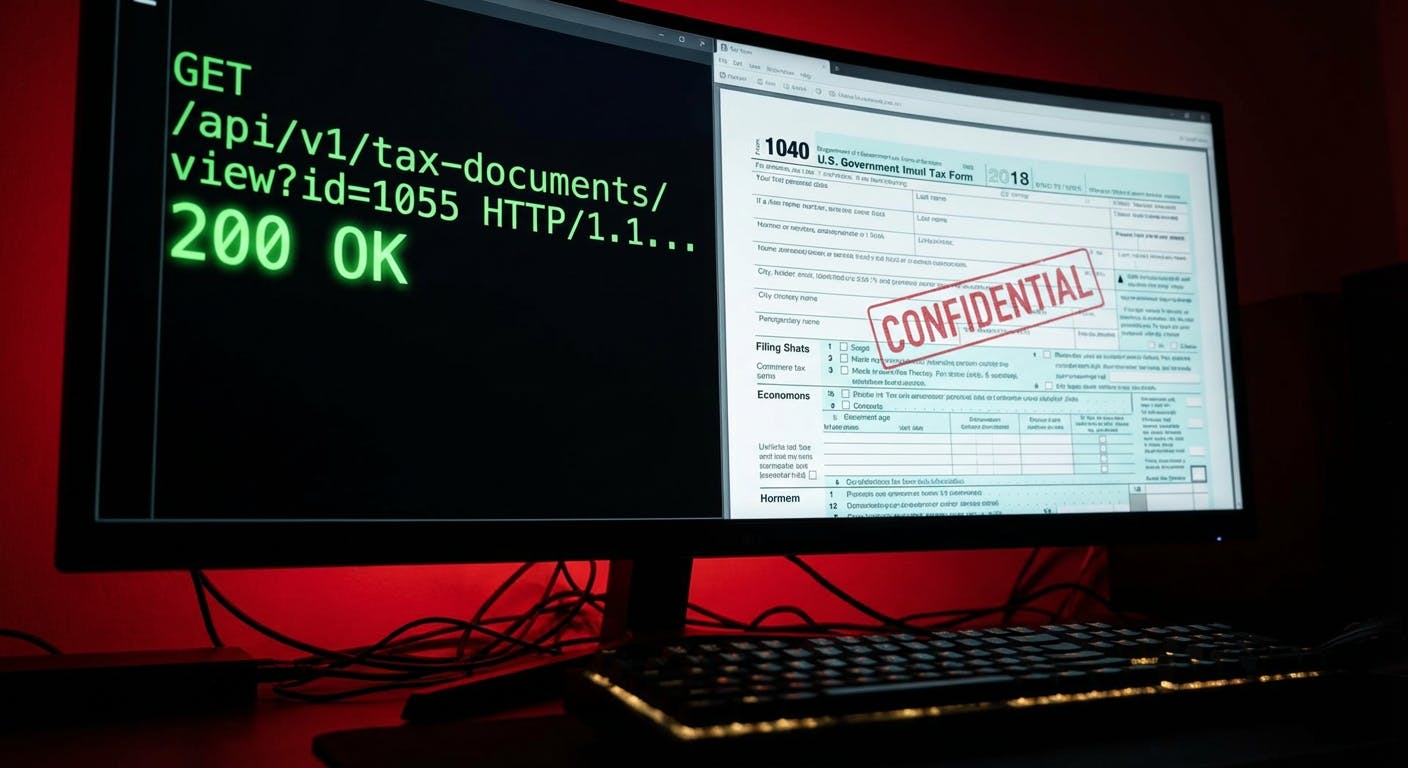

While testing a tax software API for a bug bounty, I discovered a critical Insecure Direct Object Reference (IDOR). By changing a single integer in the URL, I bypassed authentication and accessed a stranger's full tax return. I realized I was one script away from downloading the entire country's financial data.

Explore the next big crypto coin for long-term growth in 2026. Zero Knowledge Proof leads in privacy and AI, outperforming Sui, Aptos, and Toncoin. Compare features, prices, and potential returns now.

Micron's memory chips are in huge demand.

Discover the top AI integration companies for 2026, helping enterprises deploy scalable AI, machine learning, automation, and data-driven solutions.

Nigeria’s creator economy is maturing, with creators earning meaningful income and platforms multiplying, signalling a growing and vibrant digital ecosystem.

Shares to buy or sell: Chandan Taparia has recommended three stocks to buy today, 20 January 2026. Taparia recommends buying HCL Technologies, Federal Bank and Hindustan Unilever (HUL) shares.