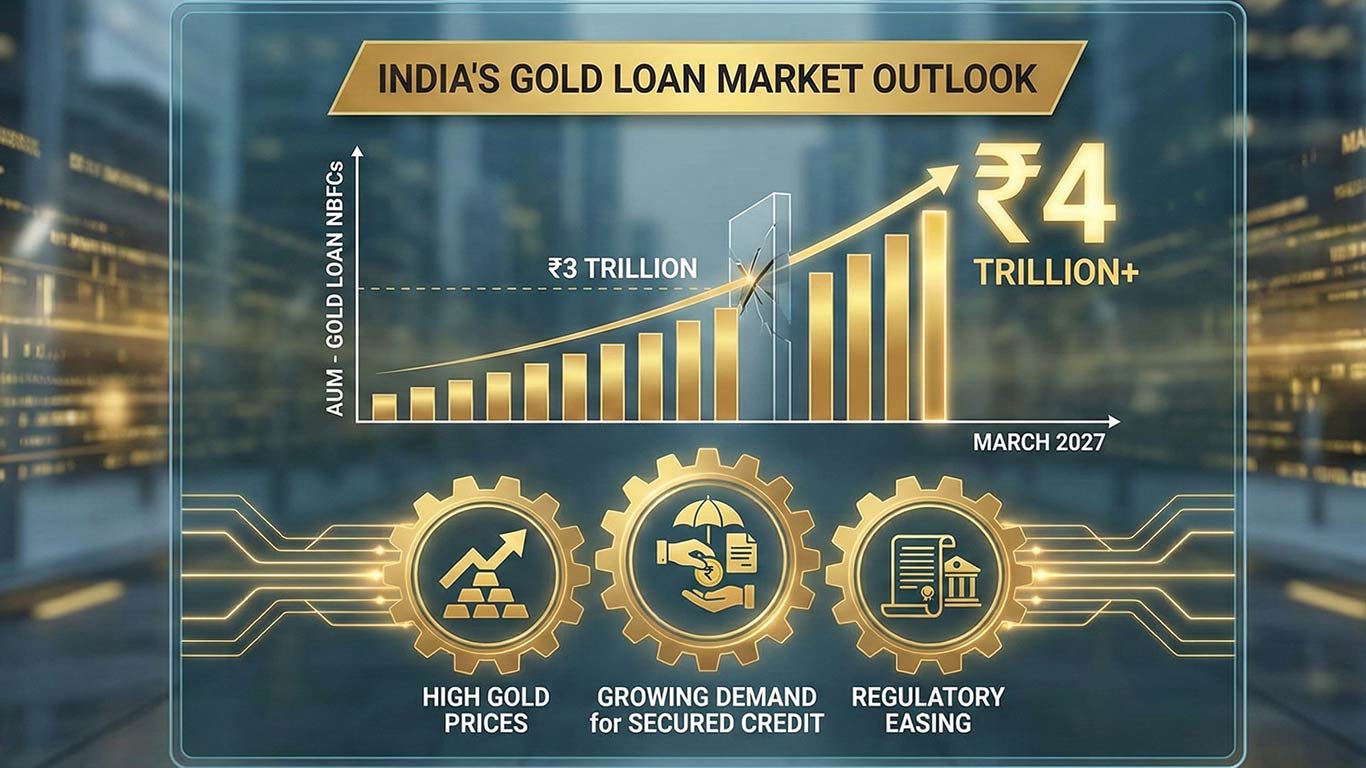

Gold-Loan NBFCs’ AUM To Surge Amid Rising Gold Prices & Secured Credit Demand: Crisil Ratings

Gold-Loan NBFCs’ AUM To Surge Amid Rising Gold Prices & Secured Credit Demand: Crisil Ratings New Delhi, Jan 24 (KNN) Assets under management (AUM) of gold loan-focused non-banking financial companies (NBFCs) are expected to cross Rs 4 trillion by March 2027, driven by high gold prices, growing demand for secured credit and regulatory easing, according to Crisil Ratings.Crisil expects gold-loan NBFCs to grow at a compound annual rate of about 40 per cent between FY25 and FY27, much faster than the 27 per cent growth recorded between FY23 and FY25.Gold Prices Drive GrowthA sharp rise in gold prices has boosted lending capacity. Gold prices rose nearly 68 per cent in the first nine months of the current fiscal, increasing the value of collateral and allowing higher loan disbursements.Aparna Kirubakaran, Director, Crisil Ratings, said, “Large gold-loan NBFCs, having an established brand image, are scaling up their portfolio across existing branches. Meanwhile, their mid-sized counterparts are adopting a dual strategy of expanding their branch network as well as operating as originating partners for large NBFCs and banks.”She noted that, as a result, average AUM per branch rose by about 40 per cent over two years, reaching around Rs 14 crore in the first half of the current fiscal, up from Rs 10 crore in FY24.Shift Towards Secured LoansStress in unsecured lending, due to tighter norms and asset quality concerns, has reduced credit availability in that segment. This has pushed borrowers towards secured options such as gold loans, which offer faster access to funds and flexible repayment options.Regulatory Support AheadGrowth is expected to get a further boost from revised loan-to-value (LTV) norms for smaller gold loans from April 1, 2026. Crisil estimates LTVs could rise to 70–75 per cent from 65–68 per cent, improving borrowing capacity even after factoring in interest.Risks to WatchCrisil cautioned that higher lending at elevated LTVs increases exposure to gold price swings. Strong risk controls, careful LTV monitoring and disciplined auction practices will be critical. Rising competition from banks expanding in the gold loan segment also remains a key challenge.(KNN Bureau)