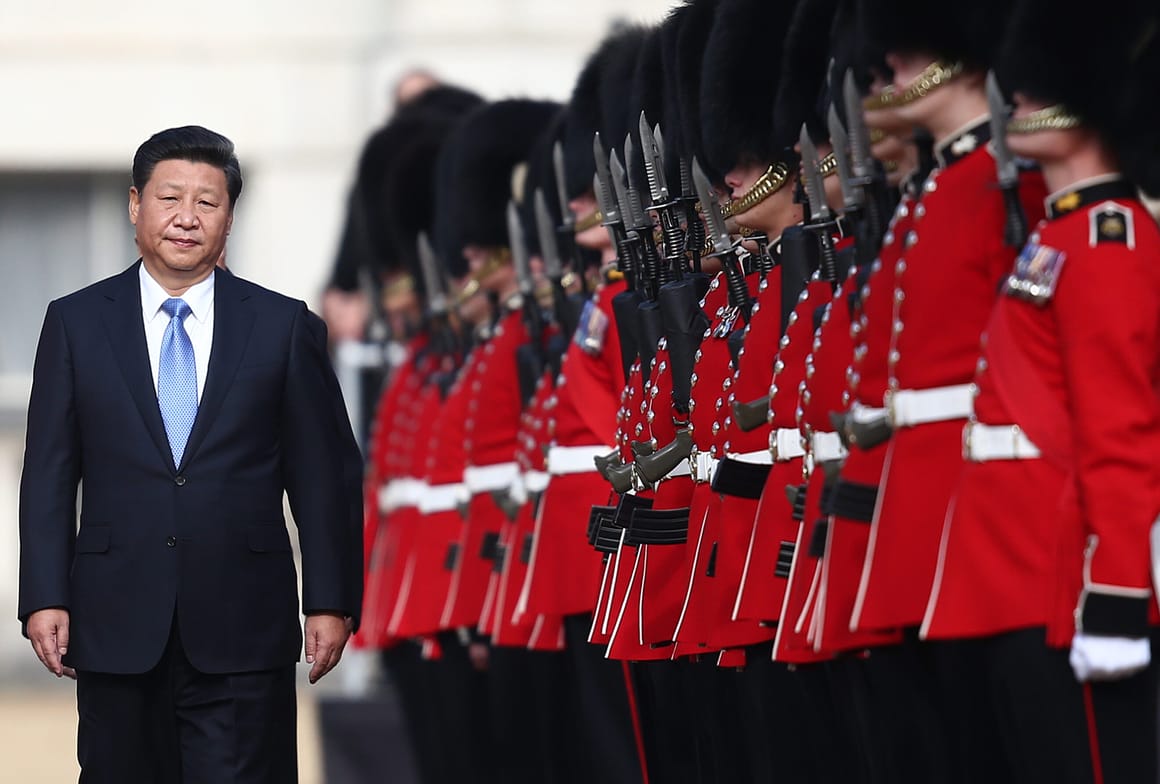

UK opens door to Xi Jinping visit

Keir Starmer's China visit is not a "one-and-done summit," Downing Street said.

Keir Starmer's China visit is not a "one-and-done summit," Downing Street said.

KeySmart's new dual-network SmartCard works with Apple FindMy and Google Find Hub, so you can track your wallet with any phone.

After months of compressed price action, XRP is back in focus after a widely followed crypto trader on X highlighted a significant shift on the weekly chart. The asset is now showing a technical signal that has historically appeared near major turning points, sparking debate over whether this setup can realistically support a move back toward XRP’s prior all-time highs. XRP’s Multi-Year Range Holds As Bullish Momentum Emerges The crypto trader notes that XRP’s current market structure remains anchored to a clearly defined weekly price range that dates back to the 2018 cycle peak. This long-standing zone, stretching roughly from the low-$2 area to the low-$3 region, has functioned as a structural equilibrium for XRP across multiple market phases. Since late 2024, XRP’s price has stayed compressed within this range, repeatedly testing both support and resistance without delivering a decisive breakout or breakdown. Related Reading: What’s Going On With The US Dollar And How Does It Affect Bitcoin, Ethereum Prices? What differentiates the current setup from previous failures is the behavior of momentum. On recent weekly lows, momentum indicators have begun forming higher lows even as price revisits familiar support levels. In practical terms, downside moves are losing strength, signaling that selling pressure is weakening. This bullish divergence suggests distribution is fading, with sellers expending more effort for diminishing downside results. The chart shared by the trader reinforces this view, showing price holding range support while underlying momentum trends higher. From a structural perspective, this consolidation reflects absorption rather than weakness. Short-term participants are gradually replaced by longer-term holders, improving market stability. While a bullish divergence alone does not guarantee a return to all-time highs, it reopens that discussion in a technically credible way. A sustained breakout above the upper boundary of this multi-year range would be the key confirmation. Until that occurs, ATHs remain a conditional outcome—but the divergence signals that the groundwork for such a move may now be forming. Macro Rotation And The Case For A Delayed Altcoin Catch-Up The broader market context reinforces the significance of the trader’s weekly XRP analysis. Equities continue to reach record highs, metals are losing momentum, and the US dollar is falling—conditions that historically signal capital rotation. Yet, many altcoins, including XRP, remain sidelined in sentiment, largely overlooked after underperforming relative to newer narratives. Related Reading: Bitcoin Price Prediction: Analyst Forecasts 72.86% Crash To $30,000 According to the crypto trader, this disconnect is notable: altcoins still trade well above bear-market lows, but cautious positioning creates the potential for asymmetric gains if capital rotates from crowded trades. The bullish divergence on XRP’s weekly chart does not guarantee an immediate rally or automatic return to all-time highs. However, it signals that structural groundwork for a larger move is forming. If XRP can reclaim and break above the upper boundary of its multi-year range with conviction, the case for revisiting previous peaks becomes materially stronger. This setup reflects temporary frustration, not failure. Momentum is building, and while patience is required, the chart suggests the market is positioning correctly for a potential delayed catch-up in the altcoin sector. Featured image created with Dall.E, chart from Tradingview.com

The latest iteration of Logitech's venerable MX Master mouse upgrades your productivity with a new Actions Ring that gives you an on-screen menu that you can customize to fit all of your needs.

Institutional participation in crypto markets is no longer a theory — it is an ongoing shift. Banks, hedge...

IT sector faces AI-era uncertainties as global model power concentrates, says Economic Survey

It's a great NAS with great hardware, but the lack of SSH access is frustrating.

ZKP leads focus with an impressive giveaway as Pi Network expands participation & Cardano reassesses fundamentals. Explore the best crypto presale!

Investors chasing 10,000% crypto returns are shifting from Shiba Inu and Dogecoin to early-stage token Little Pepe.

ZUG, Switzerland--(BUSINESS WIRE)--Chronicle, a leading provider of oracle infrastructure and verifiable onchain finance, announced its role in MoonPay's enterprise stablecoin services built on the M0 platform. Chronicle's oracle technology ensures the secure and accurate minting and redemption of any MoonPay issued stablecoins, providing continuous verification of underlying assets backing and maintaining the integrity of the digital dollar infrastructure. As MoonPay scales its stablecoin issu

The owner of a south Essex vape retailer has shared his worries around a new government policy, warning it could affect jobs and fuel illegal activity