Presque Isle is going on offense to spark growth

The biggest city in Maine’s northernmost county has seen its population decline and businesses pack up and leave for decades.

The biggest city in Maine’s northernmost county has seen its population decline and businesses pack up and leave for decades.

Construction workloads in NI continued to decline through the final quarter of 2025, a report said today.

Luxembourg, February 5, 2026 - ArcelorMittal (referred to as “ArcelorMittal” or the “Company” or the "Group") (MT (New York, Amsterdam, Paris, Luxembourg), MTS (Madrid)), the world’s leading integrated steel and mining company, today announced results1 for the three-month and twelve-month periods ended December 31, 2025

Precious metals, oil slide as global tensions ease; copper down ReutersSilver price plunges to $80 as demand for safe-haven assets wanes Yahoo Finance UKGold rebounds above $5,000 after US downs Iran drone BBCA gold and silver reset, not a reversal ING ThinkSilver’s Sudden 17% Plunge Wipes Out Two-Day Recovery From Rout Bloomberg.com

Compared to the optimistic forecasts at the beginning of the year, Estonia’s economy grew modestly by 1%, according to preliminary estimates. The construction market stabilised, with a slight increase in activity in the second half of the year in both the buildings and infrastructure segments. The construction price index increased by 1.5% in 2025 compared to 2024, primarily due to an upward trend in material prices.Nordecon’s revenue for 2025 decreased compared to 2024, primarily due to a roughly 10% decline in revenue generated by the Buildings segment. Revenue generated by the Infrastructure segment grew by 10%. The Buildings segment accounted for 81% of the group’s total revenue, with no significant change in the revenue breakdown between segments compared to the prior year. In 2025, the group substantially increased its order book, paving the way for revenue growth in 2026.The group’s gross margin was 6.5% and operating margin was 2.7%. Net profit for the period was primarily affected by the foreign exchange loss caused by the weakening of the Ukrainian hryvnia against the euro.During the year, i.e. compared to 31 December 2024, the group’s order book grew by 30%, driven by a nearly threefold increase in the order book of the Infrastructure segment. Approximately 69% of the group’s order book comprises work scheduled for 2026, with the remainder spread across 2027–2028.

The cryptocurrency market experienced a significant downturn, with nearly $500 billion wiped off its total value in a week. Bitcoin and Ethereum saw substantial drops, reflecting a broader risk-off sentiment in global markets. Analysts suggest this volatility is driven by macro factors and elevated leverage, with near-term price action expected to be range-bound.

Ultrapar Participações S.A. (NYSE:UGP) is one of the 7 Penny Stocks With Low Forward P/E Ratios to Look For. On January 27, Ultrapar Participações reported in an SEC filing that its shareholders, Squadra Investimentos – Gestão de Recursos LTDA and its affiliate Squadra Investments – Gestão de Recursos LTDA, have reduced their aggregate stake in [...]

Benchmark indices Sensex and Nifty tumbled on Thursday, halting a three-session winning streak; Know key reasons behind the fall

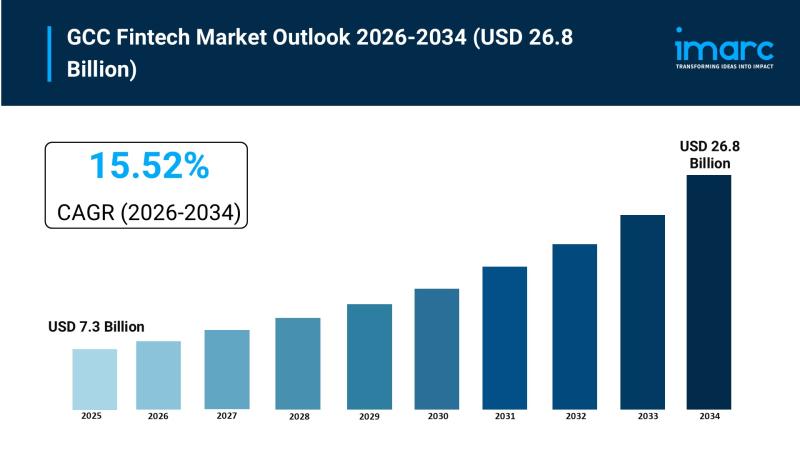

GCC Fintech Market OverviewMarket Size in 2025: USD 7.3 BillionMarket Size in 2034: USD 26.8 BillionMarket Growth Rate 2026-2034: 15.52%According to IMARC Group's latest research publication, "GCC Fintech Market Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The GCC

MUMBAI: The Indian rupee was little changed in early trading on Thursday, wedged between modest declines in regional peers and dollar sales from foreign and local private lenders, most likely on behalf of corporate clients.Dollar-rupee forward premiums, meanwhile, extended their weekly decline with the 1-year implied yield easing to an over one-month low of 2.39%, down about 20 basis points this week.Easing of immediate rupee depreciation pressures following the US trade deal, pickup in exporter hedging activity and improvement in domestic rupee liquidity all contributed to pushing forward premiums lower, traders said.“Overall, interbank bias appears skewed towards receiving far forwards at the moment,” a swap trader at a bank said. In the spot market, the rupee was down marginally at 90.45 per dollar as of 09:50 a.m. IST.The currency is up more than 1.5% on the week so far. While the US-India trade deal announcement has removed some uncertainty over Indian assets, traders and analysts are still awaiting the finer print for details.“No official documents have been released, and neither side has formally published the final terms.Market is now waiting for confirmation and finer details before extending the rupee’s rally further,“ said Amit Pabari, managing director at FX advisory firm CR Forex.In global markets, Asian currencies were trading with modest cuts, while Asian stocks slumped as concerns about the exploding costs of artificial intelligence investment encouraged a rotation out of tech.MSCI’s gauge of Asian shares outside of Japan was down over 1.5%, while Indian equities were faring better with only a 0.3% cut on the benchmark Nifty 50 index.

The world's most popular cryptocurrency has fallen nearly 20 percent in value since the start of 2026.

The Indian rupee was little changed in early trading on Thursday, wedged between modest declines in regional peers and dollar sales from foreign and...