How Colorado sparked a global push for salary transparency

Colorado’s pay-transparency law didn’t just change job ads — it changed the conversation about wages.

Colorado’s pay-transparency law didn’t just change job ads — it changed the conversation about wages.

Donlin’s net present value is now projected to be $5.1 billion, up from the $3 billion previously.

'Repatriate The Gold': German Economists Urge Withdrawal From US Vaults Authored by Kate Connolly via The Guardian,Shift in relations and unpredictability of Donald Trump make it ‘risky to store so much gold in the US’, say expertsGermany is facing calls to withdraw its billions of euros’ worth of gold from US vaults, spurred on by the shift in transatlantic relations and the unpredictability of Donald Trump.Germany holds the world’s second biggest national gold reserves after the US, of which approximately €164bn (£122bn) worth – 1,236 tonnes – is stored in New York.Emanuel Mönch, a leading economist and former head of research at Germany’s federal bank, the Bundesbank, called for the gold to be brought home, saying it was too “risky” for it to be kept in the US under the current administration.“Given the current geopolitical situation, it seems risky to store so much gold in the US,” he told the financial newspaper Handelsblatt. “In the interest of greater strategic independence from the US, the Bundesbank would therefore be well advised to consider repatriating the gold.”Stefan Kornelius, the spokesperson for Friedrich Merz’s coalition government, said recently that withdrawal of the gold reserves was not currently under consideration.But Mönch is only the latest in a string of economists and financial experts to argue that such a move would be in keeping with the greater strategic independence that Europe’s largest economy has been seeking from the US in recent months.Michael Jäger, the head of the European Taxpayers Association (TAE) as well as the Association of German Taxpayers, has also said Berlin should make its move, arguing that the US’s stated desire to seize Greenland should concentrate minds.“Trump is unpredictable and he does everything to generate revenue. That’s why our gold is no longer safe in the Fed’s vaults,” Jäger told the Rheinische Post. “What happens if the Greenland provocation continues? ... The risk is increasing that the German Bundesbank will no longer be able to access its gold. Therefore, it should repatriate its reserves.”Jäger said he had written last year to the Bundesbank and the finance ministry, urging them to “bring our gold home”.Until recently the gold issue has been the preserve mainly of the far-right Alternative für Deutschland (AfD), which has repeatedly urged the return of the gold for patriotic reasons. But it has increasingly crept into the mainstream discourse.Katharina Beck, the finance spokesperson for the opposition Greens in the Bundestag, has also spoken out in favour of relocating the gold bars, calling them an “important anchor of stability and trust”, which “must not become pawns in geopolitical disputes”.However, Clemens Fuest, the president of the Institute for Economic Research (Ifo) and one of the country’s most prominent economists, warned against such a move, saying it could lead to unintended consequences and would “only pour oil on the fire of the current situation”, he told the Rheinische Post.Germany’s total gold reserves are worth almost €450bn.Just over half are held at the Bundesbank in Frankfurt am Main, 37% in the vaults of the US Federal Reserve in New York and 12% at the Bank of England in London, the global centre of gold trading. The Bundesbank says it regularly undertakes an audit of the supplies of gold it holds in storage.Speaking last October at the International Monetary Fund’s (IMF) autumn meetings in Washington DC, the Bundesbank president, Joachim Nagel, assured attenders there was “no cause for concern” over the German gold held at the US Federal Reserve.Frauke Heiligenstadt, the parliamentary group spokesperson on financial policy for the Social Democrats, junior partners in the government, said that while she understood concerns about the gold reserves, there was no need for panic.“Germany’s gold reserves are well diversified,” she said. Because half of them are located in Frankfurt, “our ability to act is guaranteed”. Having gold in New York made sense, she added, because “Germany, Europe and the US are closely linked in terms of financial policy”.But, amid Trump’s hardening rhetoric towards his western partners, an increasing number of Merz’s Christian Democrats have been speaking out in favour of relocation.“Due to the Trump administration, the US is no longer a reliable partner,” Ulrike Neyer, a professor of economics at the University of Düsseldorf, told the Rheinische Post. Tyler DurdenSun, 01/25/2026 - 09:20

(MENAFN - Khaleej Times) Financial markets are entering 2026 under a familiar but intensified strain: the growing dominance of geopolitics over price discovery. Markets have always priced ...

Bull market cycles create extraordinary wealth through strategic presale entry positioning capital before mainstream adoption drives exponential price appreciation. BlockchainFX and Pepeto compete for investor allocation promising superior ROI as 2026 bull run momentum builds across cryptocurrency markets. BlockchainFX emphasizes

(MENAFN - Daily Forex) GoldThere's almost no way I can do any analysis of the overall markets without looking at gold. The gold market ended the week hanging around just below the crucial $5000 ...

(MENAFN - Daily Forex) WTI Crude Oil on Tuesday, Wednesday and Thursday did try to sustain prices above the 60.000 USD mark. However, plenty of the times during last week WTI Crude Oil was also ...

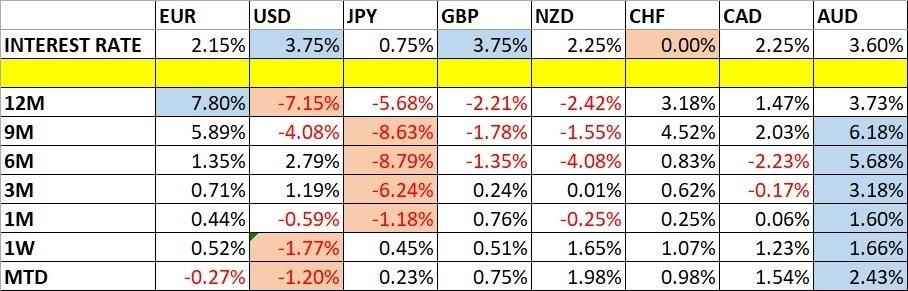

(MENAFN - Daily Forex) Friday's trading in the broad Forex market saw widespread volatility develop. The EUR/USD was part of this mixture. Day traders who have been seeking volatility in Forex and ...

(MENAFN - Daily Forex) Fundamental Analysis & Market SentimentI wrote on the 11th January that the best trades for the week would be: Long of the USD/JPY currency pair following a daily close above ...

Dreary Russian shop sim I Have No Change announced Niche Gamer

Federal tax credits for electric vehicle purchases and energy‐efficient home upgrades are no longer available for 2026.

The Road to Wrestlemania starts here.