Financial News

Looking for the Next Cardano? This Layer-1 Blockchain Presale Could Be Your Golden Opportunity

As someone who's followed the cryptocurrency market through its highs and lows for over a decade, I've seen projects like Cardano rise from humble beginnings to become cornerstones of the industry. Cardano, with its focus on sustainability and research-driven development,

From wallets to workflows: How banks launch digital asset services

Join us for a three-session series for banking leaders that connects digital asset strategy to execution—starting with wallets and ending with scalable, secure architecture.

More AI malware has been found - and this time, crypto developers are under attack

KONNI is using AI-generated backdoors to target crypto bros - and security pros should pay attention.

Top Crypto to Invest In Q2 2026: IONX Chain, Bitcoin, and Ethereum Comparison - One Clear Winner

As someone who's spent years following the ups and downs of the cryptocurrency market, I've seen how the right investment at the right time can make a big difference. In Q2 2026, with Bitcoin holding steady around $180,000 and Ethereum

Top Prop Trading Firms in Nigeria

For many traders around the world, working with a prop trading firm is the most practical way to access capitalread more Top Prop Trading Firms in Nigeria

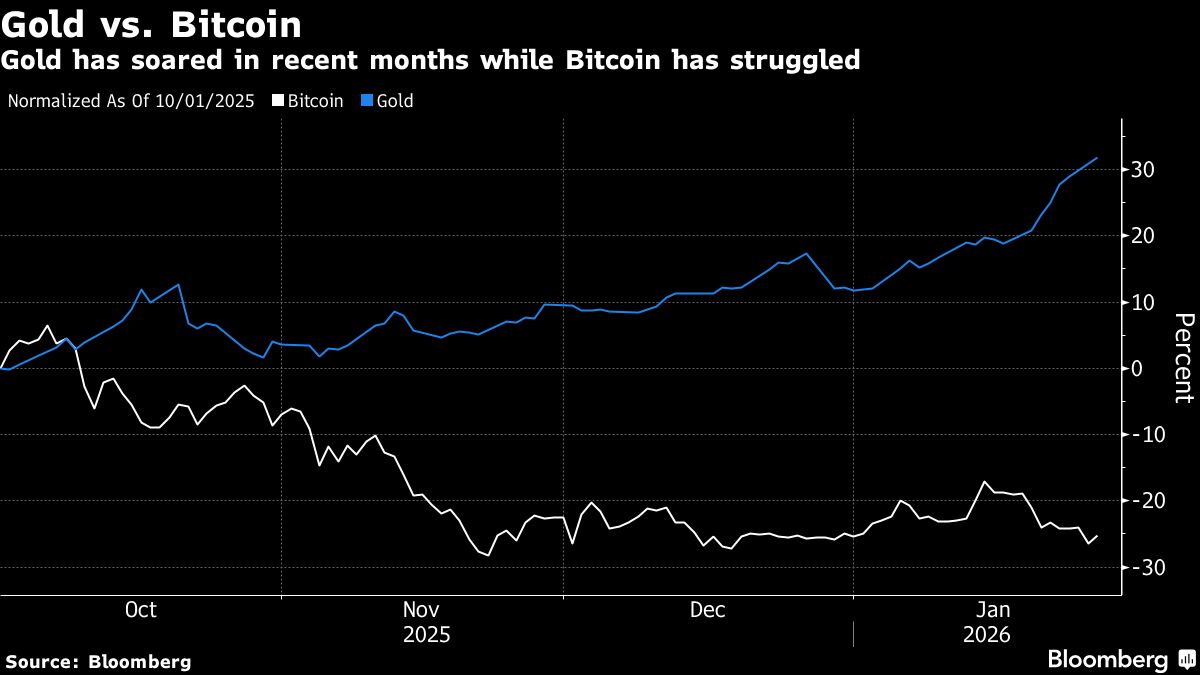

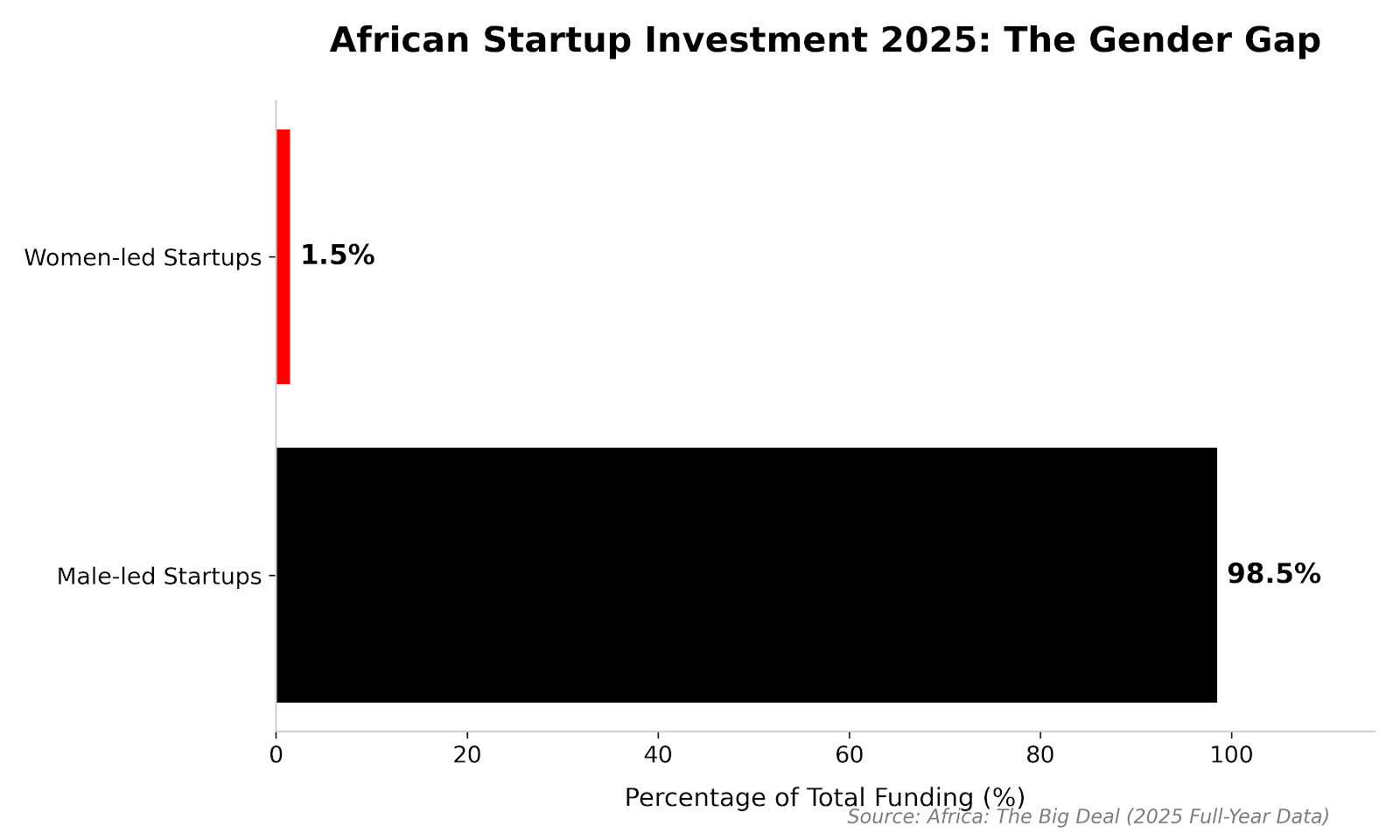

Funding rebound masks gender gap as women-led startups get under 10%

Women-led startups continue to receive a disproportionately small share of venture capital in Africa, even as the continent’s broader startupread more Funding rebound masks gender gap as women-led startups get under 10%

I’m proudly representing the North East to strengthen the region’s creative economy

A South Tyneside filmmaker has joined 16 other senior scripted leaders as part of a new flagship initiative.

The Rise of Neocloud: Why Vertical Compute Platforms Are Becoming the Real Gatekeepers of AI Scale

Artificial intelligence has accelerated beyond the limits of the infrastructure originally built to support it. Training cycles grow heavier each quarter, models demand tighter orchestration, and the gap between ambition and capacity widens. Teams often describe their challenges as algorithmic, yet many of the real failures occur where few are looking: beneath the model layer. [...]The post The Rise of Neocloud: Why Vertical Compute Platforms Are Becoming the Real Gatekeepers of AI Scale appeared first on TechBullion.

A powerful AMD gaming desktop is hundreds off at Costco - The Verge

A powerful AMD gaming desktop is hundreds off at Costco The VergeThe iBuypower Month End Clearance Sale Has Excellent Ready to Ship Gaming PC Deals IGNGet AMD's 16GB RX 9060 XT for the MSRP price of an 8GB RTX 5060 Ti — Newegg discount code unlocks $20 saving on double the VRAM Tom's HardwareEven in 2026's component hellscape, AMD's Radeon RX 9070 XT is that rarest of things: a high-end GPU that’s still decent value Rock Paper ShotgunNewegg slashes $600 off stylish Skytech RX 9070 XT, 9800X3D gaming PC PC Guide

Public meeting to discuss home-to-school transport concerns in North Yorkshire

Plans for a public meeting in Wharfedale to discuss the implications of the controversial home-to-school transport policy change have been announced.

Should You Pay Off Your Mortgage Early Or Invest the Extra Cash Instead? What Homeowners Should Do In 2026

The math is simple: if the expected return from your investments is higher than your mortgage interest rate, investing should help you grow your wealth the most over time. Key TakeawaysPaying off your mortgage early provides a guaranteed, risk-free return equal to your mortgage's after-tax interest rate, because it permanently eliminates future interest costs.Investing extra money could earn you more over time, but it’s not guaranteed and involves market risk (like selling when prices are low).With today’s higher mortgage rates in 2026, paying off debt early is much more attractive than it was a few years ago.Your best decision depends on four main factors: how easily you can access your cash (liquidity), your tax bracket, how prices are rising (inflation), and your personal money habits.Most people should use a balanced approach: a mix of paying down debt and investing.The financial landscape for homeowners has changed significantly in 2026. While prices aren’t rising as fast, the cost of borrowing is still high. Mortgage interest rates have jumped. At the same time, the stock market still offers a chance to build significant wealth in the coming years. This begs the question: should you use extra money to pay off your mortgage faster or put it into long-term investments?The best choice depends on several factors: your exact mortgage rate, the money you expect to earn from investing (ROI), how inflation changes the value of your debt, your tax situation, and your personal discipline with money. You need to look at the facts and figures to make a smart, data-driven choice, rather than just going with a gut feeling. The final decision is based on both numbers and personal behavior.Why Paying Off Debt Is More Relevant Now In 2026In the 2010s, with mortgage rates below 4%, it was usually better to invest because the stock market often returned much more than the cost of borrowing. The math clearly favored investing then. But the situation is reversed for homeowners in 2026. Current average mortgage rates are much higher. This higher borrowing cost means that when you pay off your loan early, you get a higher “guaranteed return” simply by avoiding that high interest payment.The stock market still has the potential for large long-term growth, even with occasional crashes. However, the difference between the guaranteed savings from paying off your mortgage and the potential, but uncertain, higher return from investing is now much smaller. Because the numbers are so close, the decision is no longer easy. It now mostly comes down to your personal financial goals and the level of risk you are comfortable with.How Paying Down Principal WorksEvery mortgage payment you make is split between paying down the loan itself (the principal) and the lender’s fee (the interest). Early in the loan, most of your payment goes to interest. When you make an extra payment and specifically mark it for principal, you immediately lower your total loan balance. Paying down the principal faster does two things: it shortens your loan term and greatly reduces the total amount of interest you pay over the life of the loan.For instance, even small, regular extra payments on a 30-year mortgage, especially early on, create huge savings. These extra payments can cut years off your repayment schedule and save you a massive amount in interest. This saving is certain: once the principal is reduced, the interest you avoid paying is locked in and guaranteed.The Guaranteed Return From Paying Off DebtWhen you pay down your mortgage principal early, the financial benefit you receive equals the interest rate on your loan. You are essentially earning a “return” by avoiding future interest payments. So, if your mortgage rate is 6.5%, every dollar you use to ...Full story available on Benzinga.com