Quantum Computing Stock Soars: Buy or Sell Now?

Will this stock be the next quantum breakout, or a speculative trap waiting to reset?

Will this stock be the next quantum breakout, or a speculative trap waiting to reset?

Digital lender GoTyme Bank is looking at a potential initial public offering in three to four years as it focuses on doubling its customer base and significantly expanding its business scale, according to its top executive.

Integra Resources CEO George Salamis said the advancements in 2025 at the Florida Canyon Mine and the Nevada North Project in Nevada and the DeLamar Project in Idaho validate “the strategic rationale behind acquiring Florida Canyon in late 2024.”

Inuit consultations concluded and regulatory hurdles completed

The Philippine economy closed 2025 with 4.4 percent growth, missing the government’s growth target for the third straight year, weighed down by a flood control corruption controversy and unfavorable weather conditions.

Petroliam Nasional Bhd (PETRONAS) seeks to sustain domestic hydrocarbon production close to two million barrels of oil equivalent per day (boe/d), amid maturing fields, rising costs and growing energy security concerns. Read full story

The Economy and Development Council chaired by President Marcos has set 2026 as a rally point to fast-track the implementation of its overall development blueprint and to restore public confidence.

The ringgit closed lower against the US dollar yesterday following the United States Federal Reserve's (Fed) decision to keep interest rates unchanged, which supported the greenback. Read full story

Popular, Inc. offers retail and commercial banking services across Puerto Rico, the U.S., and the British Virgin Islands.

Major cryptocurrencies plummeted on Thursday, with Bitcoin falling 5% and Ethereum dropping nearly 7% by mid-morning, amid a wave of geopolitical and tech-sector concerns.The slump came as tensions ro...

Reducing the food weight would have important ramifications for the Reserve Bank of Indias monetary policy.

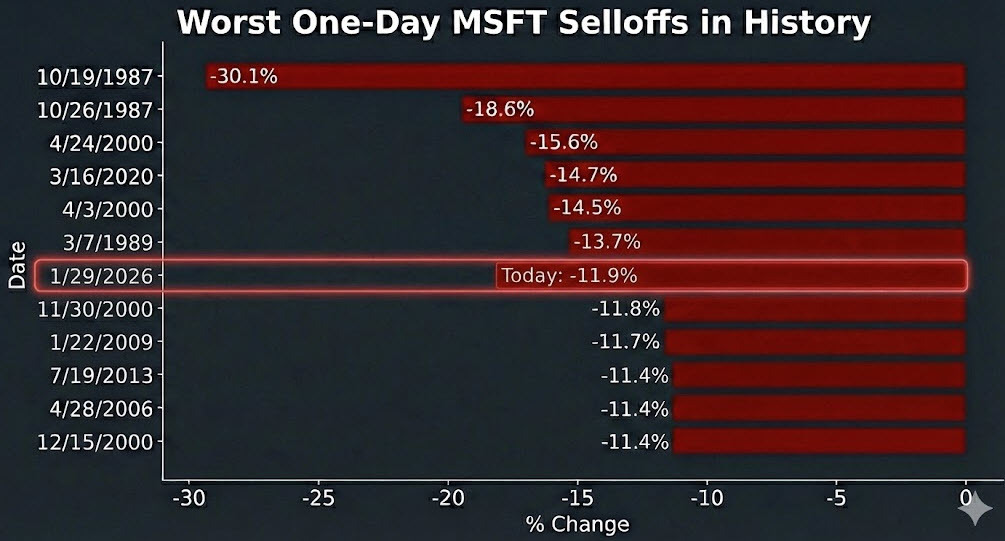

Is OpenAI suddenly toxic?The market is sensing that ChatGPT is going to lose the generative AI race because they can't keep up with the spending of Google and others. Plus they don't have the data and integration of their megacap competitors.Microsoft posted a 24% rise in y/y earnings today but shares are down 11.5%. That makes today the 9th worst day ever for Microsoft stock by by far the largest single-day drop in market cap.In fact, this is the second-largest single day market cap destruction after the Jan 28, 2025 decline in NVDA. Here is the chart of the worst ever days for market cap wipeouts. It doesn't include MSFT stock today but it's down around $400 billion.The company has bet big on OpenAI and the market is questioning the wisdom of that, with new disclosures revealing that OpenAI accounts for 45% of Microsoft's total long-term backlog. This unusually high concentration has raised concerns about Microsoft's exposure to a single partner, especially amidst questions about OpenAI's future funding needs.In the core business, Azure revenue grew by 38–39% (beating guidance slightly) but decelerated compared to the previous quarter (40%) and barely surpassed the high expectations built into the stock price. Analysts at Evercore noted that investors are now demanding "clearer evidence" that the elevated spending is translating into faster growth, which wasn't sufficiently visible in this report.The primary driver of the negative sentiment is the 66% year-over-year jump in capital spending, which hit a record $37.5 billion for the quarter. Investors are spooked by the sheer scale of the spending on AI infrastructure without seeing a proportional acceleration in immediate revenue. The market may also question whether MSFT can execute after the terrible co-pilot rollout.Overall, this isn't a great sign of market sentiment and the AI trade and you can see that in a 2.4% decline in the Nasdaq. This article was written by Adam Button at investinglive.com.