Rupee touches all-time low of 92.02/$, pares losses to end at 91.97

Weak equities, FII outflows and a firm dollar weighed on the currency amid geopolitical uncertainty

Weak equities, FII outflows and a firm dollar weighed on the currency amid geopolitical uncertainty

The two most popular cryptocurrencies -- Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) -- are trading well below their all-time highs from just a few months ago. Bitcoin is down about 30% from its all-time high of $126,198 in October, while Ethereum is down roughly 40% from its all-time high of...

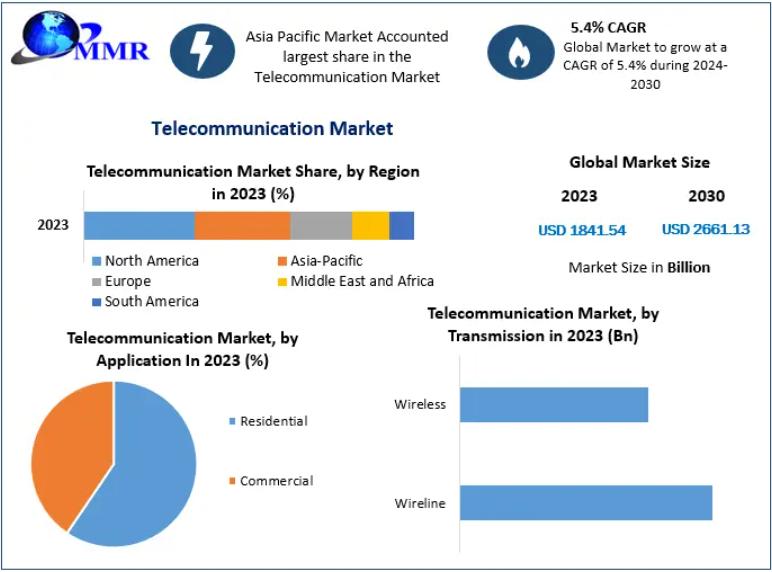

The Global Telecommunication Market was valued at US$ 1,841.54 Billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030, reaching approximately US$ 2,661.13 Billion by 2030.Telecommunication Market OverviewTelecommunication involves the transmission of data,

The rupee hits a record low of 92.02 against the dollar before closing slightly higher at 91.97.

BitcoinWorldBinance MEGA Futures: Strategic Expansion into Pre-Market Perpetual Contracts with 5x LeverageGlobal cryptocurrency exchange Binance has strategically announced the listing of MEGA/USDT pre-market perpetual futures contracts, scheduled for January 30, 2025, at 12:30 p.m. UTC. This significant development expands the platform’s derivatives offerings while providing traders with early access to a new market with up to five times leverage. The announcement follows Binance’s established pattern of [...]This post Binance MEGA Futures: Strategic Expansion into Pre-Market Perpetual Contracts with 5x Leverage first appeared on BitcoinWorld.

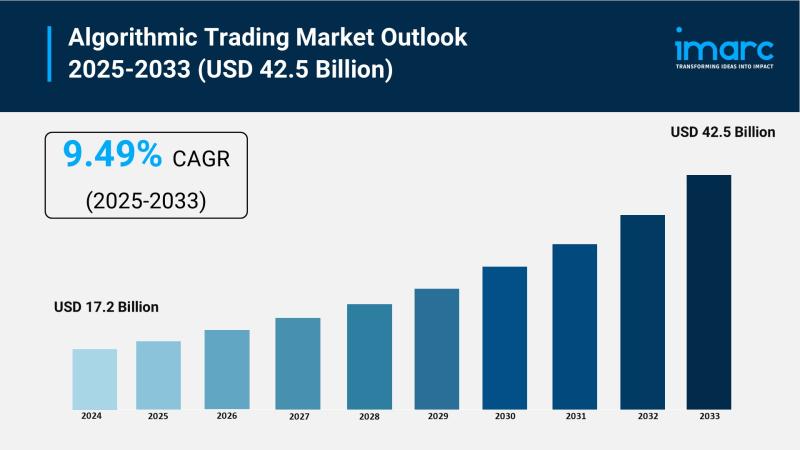

Market Overview:The Algorithmic Trading Market is experiencing explosive expansion, driven by Growing Use of Artificial Intelligence and Machine Learning, Rising Demand for High-Frequency Trading And Need for Better Efficiency and Lower Costs. According to IMARC Group's latest research publication, "Algorithmic

Gold just ripped to a new all‐time high above 5,500 as volatility went from “interesting” to “historic” in a single session. For traders, this is exactly the kind of market they dream about – and the kind of moment where many brokers quietly move the goalposts.When volatility spikes, the playbook at a lot of firms is simple: widen spreads, hike costs, and make traders pay for the uncertainty. Overnight, many brokers did exactly that on XAU/USD, pushing spreads out to protect their own risk at the expense of client opportunity.PrimeXBT, a global multi-asset broker, chose a different path.Volatility without penalty: spreads stay tightDespite an unprecedented move in gold and a fresh all‐time high at 5,597.69 (at the time of writing), PrimeXBT kept XAU/USD spreads unchanged, starting from just 15 pips. No “volatile markets” disclaimer, no post‐hoc repricing, no last‐minute spread shock – just the same ultra‐competitive conditions traders had the day before the breakout.For active gold traders, that matters for three reasons:Every pip counts in a move like this. When gold is moving tens of dollars in minutes, spread is the invisible tax on every decision. Keeping spreads tight means more of the move ends up in the trader’s P&L, not the broker’s.No hidden volatility premium. Many platforms talk about “supporting traders through volatility” then quietly double or triple spreads when markets heat up. PrimeXBT’s decision to hold spreads is a clear signal: conditions are there to be traded, not priced away.Confidence in execution. In extreme markets, traders need to trust that the price they see is the price they’re actually playing. Stable, transparent spreads are a sign that the broker’s infrastructure and risk management are built for stress, not just calm seas.When other brokers panicked, PrimeXBT leaned inGold’s surge is exactly the kind of event that exposes whether a platform is built around traders or around short‐term risk aversion.While many brokers reacted by:Widening spreads to “manage risk”Limiting instruments or position sizesPushing through execution slippage masked as “market conditions”PrimeXBT leaned into its core value proposition: institutional‐style access for active traders, even when markets are at their wildest.Key points that set PrimeXBT apart in this move:XAU/USD spreads from 15 pips – held steady through the breakout.Deep multi‐asset liquidity – gold, indices, shares, FX and crypto available from a single account.High leverage on non‐crypto instruments, up to 1:2000 for experienced traders who understand risk.Zero‐fee trading structures on selected accounts, so spreads are the primary cost, not an added layer of commission.Gold volatility is a test for trading platformsUnprecedented gold volatility is not a one‐off headline; it’s a stress test of the entire trading stack: liquidity, pricing, risk management, and platform philosophy.PrimeXBT’s stance is simple:If you only offer great conditions when markets are calm, you’re not really a trader’s broker.By keeping XAU/USD spreads unchanged and highly competitive during the biggest gold move in history, PrimeXBT is sending a clear message to active traders:You don’t have to choose between volatility and fair pricing.You can trade all‐time highs without paying “panic spreads”.You can use gold, FX, indices, shares and crypto together in one unified environment, with stable conditions across the board.As gold continues to carve out new territory, PrimeXBT intends to be the platform where traders can actually trade the move, not just watch it from the sidelines.Start trading with PrimeXBT.About PrimeXBTPrimeXBT is a global multi-asset broker and crypto asset service provider trusted by traders in more than 150 countries. The platform bridges traditional and digital markets within one integrated environment, redefining versatility and innovation in online trading. Clients can access Forex, CFDs on indices, commodities, shares, crypto, and Crypto Futures, as well as buy, store and exchange cryptocurrencies directly. This unified experience extends across both the native PXTrader platform and MetaTrader 5, supported by advanced risk-management tools and a wide range of funding options in crypto, fiat and local payment methods. Since 2018, PrimeXBT has focused on empowering traders through broad multi-asset access, fair and transparent conditions, professional-grade technology and dedicated human support. By combining expertise, trust and a client-first approach, PrimeXBT sets a benchmark of excellence in the financial industry and provides traders with the tools they need to trade, grow and succeed with confidence.Disclaimer: The content provided here is for informational purposes only and is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results. The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money. The Company does not accept clients from the Restricted Jurisdictions as indicated on its website / T&Cs. Some products and services, including MT5, may not be available in your jurisdiction. The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration. This article was written by IL Contributors at investinglive.com.

The central bank still retains the ability to curb excessive foreign-exchange volatility

Deutsche Bank and its asset management arm DWS Group are weighing the possibility of taking a “significant” minority interest in insurance company Frankfurter Leben Gruppe, reported Bloomberg.The insurance consolidator is majority-owned by Fosun International.Such a move would mark Deutsche...

Apple’s iPhone 16 emerged as the world’s best-selling smartphone in 2025, with Apple and Samsung dominating the global Top 10 models. Apple secured seven spots, driven by strong demand for the iPhone 17 series, while Samsung’s Galaxy A16 5G led Android sales and the S25 Ultra gained traction in key markets.

Organizations deploying AI agents may be in for a nasty surprise when it comes to the cost of tuning their performance.According to some surveys, nearly 80% of enterprises have deployed AI agents, but most don’t understand the cost of training them and evaluating their outputs, which can result in costs far exceeding expectations, experts say.Many organizations are still experimenting to find the best ways to catch agent problems before they cause chaos after deployment, says Lior Gavish, cofounder and CTO at AI observability vendor Monte Carlo.Because many organizations use a second large language model to vet the outputs of an LLM-powered agent, agent testing can be many times more expensive than testing traditional software, he says. Moreover, this method, called LLM as a judge, can be more expensive than running the agent itself, as the cost of running an LLM over an extended period can add up quickly.“It’s tricky to test or monitor these outputs,” Gavish says. “People basically ask another LLM to rate the performance of an LLM based on various criteria, and the criteria vary wildly between different use cases.”Monte Carlo saw this problem itself when the company left an LLM-powered eval running for days and ended up with a five-figure bill, Gavish notes. “An LLM call usually is orders of magnitude more expensive than anything that we would do in traditional software,” he says.LLMs rating LLMsUsing a second LLM to review the outputs of an agent can also be problematic because it assumes the second LLM’s conclusions are accurate, Gavish says. Questions about accuracy can add to costs if organizations keep running tests to verify results.“These checks are non-deterministic and not even repeatable,” he says. “You might get different answers and different runs if you’re not careful, so it’s different from more traditional software monitoring or testing where it either passed or it failed.”The cost of agent evals can vary wildly depending on the complexity of the agent, says Russell Twilligear, head of AI R&D at AI-generated content provider BlogBuster. For example, an evaluation for a small, well-scoped agent can run into the thousands of dollars, while evals for more complex agents can cost tens of thousands of dollars, he says.“You have to factor in all of the test runs, logging, and human reviews,” Twilligear notes. “Every single change means they have to rerun the evals, and that adds up pretty fast.”Agent evals can be complicated because they test for several possible metrics, including agent reasoning, execution, data leakage, response tone, privacy, and even moral alignment, according to AI experts.Good evals incorporate a human element, with subject-matter experts needed to check agent outputs, says Paul Ferguson, founder of Clearlead AI Consulting. A major challenge in agent evals is establishing what “correct” means in ambiguous use cases, he adds.Most IT leaders budget for obvious costs — including compute time, API calls, and engineering hours — but miss the cost of human judgment in defining what Ferguson calls the “ground truth.”“When evaluating whether an agent properly handled a customer query or drafted an appropriate response, you need domain experts to manually grade outputs and achieve consensus on what ‘correct’ looks like,” he adds. “This human calibration layer is expensive and often overlooked.”Software evals can be straightforward when organizations are checking for code to compile and pass all unit tests, he says. “But for the vague queries like, ‘Help me understand this data,’ or ‘Draft a response to this customer,’ defining what constitutes a correct answer becomes genuinely difficult,” he adds. “Even humans can disagree in some cases.”Agent evaluation adviceThe sticker shock of agent evals rarely comes from the compute costs of the agent itself, but from the “non-deterministic multiplier” of testing, adds Chengyu “Cay” Zhang, founding software engineer at voice AI vendor Redcar.ai. He compares training agents to training new employees, with both having moods.“You can’t just test a prompt once; you have to test it 50 times across different scenarios to see if the agent holds up or if it hallucinates,” he says. “Every time you tweak a prompt or swap a model, you aren’t just running one test; you’re rerunning thousands of simulations.”There are several ways to run agent evals, including low-cost unit testing, synthetic grading using another AI model, red-team simulations, and high-cost human shadowing, in which a human expert runs alongside an agent for a week or more, Zhang says.Organizations often look for shortcuts, usually by relying entirely on other AI models to do the grading, he says, recommending against that route.“My view is that evaluations are an insurance policy,” he says. “Shortcuts in evals are just deferred technical debt that you pay with interest when the agent hallucinates in front of a VIP client. You might save $10,000 on evals today, but if your financial agent hallucinates a transaction, that cost is negligible compared to the brand damage.”If an organization wants to save money, the better alternative is to narrow the agent’s scope, instead of cutting back on testing, Zhang adds.“If you skip the expensive steps — like human review or red-teaming — you’re relying entirely on probability,” he says.To limit eval costs, Clearlead AI Consulting’s Ferguson recommends organizations start with use cases that have clear right and wrong answers, like code compilation, before tackling more subjective scenarios, he says.Organizations should also use LLM evaluation frameworks such as LangSmith, PromptLayer, or Ragas rather than building their own tools from scratch, he advises.IT teams should also start testing early, he adds. “Building evaluations before production is far cheaper than retrofitting them later,” Ferguson says.Monte Carlo’s Gavish offers other ways to keep costs down, such as setting spending limits for evals and performing due diligence on which LLMs they use to test agents.“You can rightsize the model a little bit,” he says. “Of course, you can use the latest and greatest ChatGPT for every evaluation, but you probably shouldn’t.”

LOS ANGELES — The Trump administration has not shied away from sharing AI-generated imagery online, embracing cartoonlike visuals and memes and promoting them on official White House channels.