forexlivehace 3d

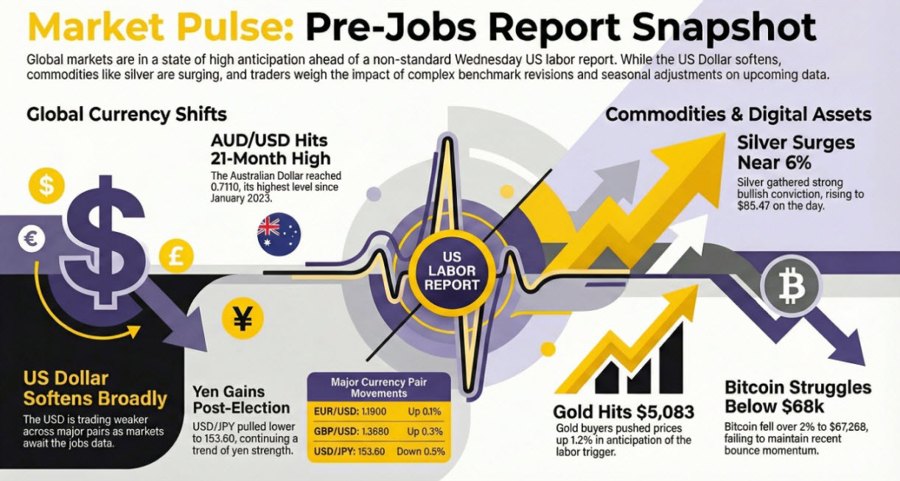

US jobs report build up:Preview: January non-farm payrolls by the numbers. The consensus is highWhat is the distribution of forecasts for the US NFP?What to watch out for in the US labour market report later?Goldman flags substantial downside risk to January jobs reportHeadlines:USD/JPY continues to unwind the run up from before the Japan snap electionThe Australian Dollar extends gains on hawkish RBA. US Dollar's fate hinges on US NFP.Precious metals remain cagey awaiting NFP triggerIt's a big day for gold as traders brace for the US NFP release. What's the trade?France lands in hot water with China's media after strategy report floats blanket tariffsChina hits back at France, says might launch investigations into French wineUnveiling the investingLive Academy: Your Path to Clear Trading EducationMarkets:US dollar weaker across the board, USD/JPY down 0.5% to 153.60Gold up 1.2% to $5,083 while silver is up 5.9% to $85.47S&P 500 futures up 0.1%, Nasdaq futures up 0.1%, Dow futures up 0.1%European indices mixed, slightly lower at the balanceBitcoin down 2.0% to $67,268US 10-year yields down 1 bps to 4.135%WTI crude oil up 2.1% to $65.35It was a slower session as markets are waiting with bated breath for the upcoming US labour market report later today. It is an unusual one to see it on a Wednesday but it is what it is after the brief US government shutdown at the start of the month.The report today will also feature annual adjustments from the benchmark revision up to March 2025 as well as an update to the birth-death model starting from April 2025 onwards with seasonal adjustment factors for the past five years. So, that will make for a less straightforward data release when trying to size up the impact later.In markets, the dollar is weaker in the run up to the key risk event. USD/JPY continues to be pulled lower, down 0.5% to 153.60 on the day. The low earlier touched 152.80 as the yen continues to keep firmer after the Japan snap election over the weekend.EUR/USD is up 0.1% to 1.1900 while GBP/USD is up 0.3% to 1.3680 on the day. Meanwhile, the aussie continues to march higher with AUD/USD up 0.5% to 0.7110 - its highest level since January 2023.Besides that, precious metals are also looking for the right kind of trigger from the data later to break higher. Gold and silver buyers are already on the edge of their seats, pushing up price as we build towards the non-farm payrolls.Gold is up 1.2% to $5,083 after a briefly clipping the $5,100 mark while silver is starting to gather more near-term bullish conviction as gains near 6% to $85.47 on the day.As for the broader risk mood, it's a bit more mixed with European indices slightly lower at the balance while US futures are keeping steadier. Wall Street observed a more sluggish showing yesterday but the mood today will largely depend on what the US labour market report has to offer. US futures are up just 0.1% currently.Meanwhile, Bitcoin is down over 2% on the day to $67,268 as cryptocurrencies continue to struggle to stay afloat on the week. The bounce from $60,000 last week looks to be short-lived but we'll see how traders will take to the jobs numbers later and if that will provide any short-term respite for cryptocurrencies.Well, it's time to count down to the only game in town today. 35 minutes and under now. Tick tock. Tick tock. This article was written by Justin Low at investinglive.com.