The best email newsletter software of 2026: Expert tested

I tested the top email newsletter platforms to help you choose the right tool for your business.

I tested the top email newsletter platforms to help you choose the right tool for your business.

All amounts are in Canadian Dollars unless otherwise noted NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES VANCOUVER, British Columbia, Jan. 26, 2026 (GLOBE NEWSWIRE) -- Oceanic Iron Ore Corp. (TSXV - FEO) ("Oceanic”, or the "Company”) is pleased to announce a brokered and non-brokered financing for up to $50 million to advance development activities at the Company’s Ungava Bay Projects in Northern Quebec, Canada.Non-Brokered OfferingThe Company is pleased to announce that it is undertaking a non-brokered private placement (the "Non-Brokered Offering”) whereby up to 49,416,800 Units ("Units”) will be issued to insiders of the Company and to strategic investors, family offices, and other accredited investors, at a price of $0.75 per Unit (the "Offering Price”), for gross proceeds of up to $37,062,600. Each Unit will consist of one common share of the Company ("Common Share”) and one-half of one warrant of the Company (each full warrant, a "Warrant”). Each whole Warrant will be exercisable to purchase one Common Share at an exercise price of $0.95 per Common Share for a period of 36 months from the Closing Date (as defined below).Bought Deal OfferingThe Company has also entered into an agreement with National Bank Financial Inc., as joint bookrunner and co-lead agent, alongside Haywood Securities Inc., as joint bookrunner and co-lead agent (collectively, the "Underwriters”) under which the Underwriters have agreed to purchase for resale on a bought deal basis 15,000,000 Units, at the same Offering Price and terms as the Non-Brokered Offering for gross proceeds of approximately $11,250,000 (the "Bought Deal Offering”, and together with the Non-Brokered Offering, the "Offerings”).The Underwriters will have an option, exercisable in whole or in part up to 48 hours prior to the Closing Date (as defined herein), to raise up to an additional 15% of the Bought Deal Offering size in Units at the Offering Price (the "Underwriters’ Option”) for potential additional gross proceeds of $1,687,500.In connection with the Bought Deal Offering, the Company will pay the Underwriters a cash fee equal to 6% of the gross proceeds from the sale of such Units, including any Units sold pursuant to the Underwriters’ Option.The Offerings are expected to close on or about February 13, 2026 ("Closing Date”) and are subject to certain closing conditions including, but not limited to, the receipt of all necessary approvals including the approval of the TSX Venture Exchange ("TSXV”) and the applicable securities regulatory authorities.The net proceeds of the Offerings will be used to fund permitting and development costs for the Company’s Hopes Advance, Morgan Lake, and Roberts Lake iron ore projects in Northern Québec, Canada, for advancing strategic investment initiatives, and for general corporate purposes.The Units will be offered in each province and territory of Canada, as well as the United States and other jurisdictions pursuant to available prospectus and/or registration exemptions and applicable securities laws. All securities issued pursuant to the Offering will be subject to a 4-month and one day hold period in accordance with applicable Canadian securities laws.The Company has been advised by key holders of its existing convertible debentures (representing approximately 91% of the combined principal balance outstanding for all series of convertible debentures), that they intend on converting all of their respective debentures contemporaneously with the Offerings. This will result in the issuance of 30,100,521 common shares and 30,100,521 share purchase warrants of the Company.The Units have not been registered and will not be registered under the U.S. Securities Act, or any state securities laws and may not be offered or sold in the United States or to, or for the account or benefit of, "U.S. Persons” (as such term is defined in Regulation S under the U.S. Securities Act of 1933, as amended) absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.OCEANIC IRON ORE CORP. (www.oceanicironore.com)On behalf of the Board of Directors"Chris Batalha”CEO and DirectorFor further information: Chris Batalha, CEO and Director, +1 (604) 566-9080.About Oceanic:Oceanic is focused on the development of its 100% owned Hopes Advance, Morgan Lake and Roberts Lake iron ore development projects located on the coast in the Labrador Trough in Québec, Canada. Oceanic’s flagship Hopes Advance Project has a NI 43-101 measured and indicated mineral resource of approximately 1.39 bn tonnes (Measured Resources - 774,241 tonnes at 32.2% Fe grade, Indicated Resources - 613,796 tonnes at 32.0% Fe) and enjoys the distinct advantage of being located at tidewater and not being reliant on third parties for key infrastructure such as port, power and especially bulk transportation to port (negating the need for any rail infrastructure).In December 2019, the Company published the results of a preliminary economic assessment completed in respect of the flagship Hopes Advance project (the "Study”) outlining a base case pre-tax NPV8 of USD$2.4 bn (post-tax NPV8 of USD $1.4 bn) over a 28 year mine life, and a life of mine operating cost of approximately USD $30/tonne, producing a blast furnace concentrate product grading at 66.5%Fe with approximately 4.5% Silica. More recently, the Company has completed preliminary metallurgical testwork that indicates the potential to produce a high-grade, direct reduction Iron product, based on bench-scale flotation testing which may be achievable with modest modifications to the existing flowsheet, thereby providing versatility in product choice and contributing to the global green-steel movement. Further information in respect of the Morgan Lake and Roberts Lake projects, both of which have been explored historically and which have defined historical resources, is also available on the Company’s website.Notes on Technical DisclosureMineral resources are not mineral reserves and do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that mineral resources will be converted to mineral reserves.The Study is based on a Mineral Resource Estimate for the Hopes Advance Project, disclosed in a technical report titled "Preliminary Economic Assessment of the Re-Scoped Hopes Advance Property” with an effective date of December 19, 2019, and filed on SEDAR+ on January 31 ,2020. The key assumptions, parameters and methods used to estimate the Mineral Resource Estimate and the identification of known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources are described in such technical report. The Study is preliminary in nature, and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the Study will be realized.The technical information contained in this news release has been reviewed and approved by Eddy Canova P. Geo, a Consultant to the Company, a Qualified Person as defined by NI 43-101 and independent of the Company.Forward Looking Statements:This news release includes certain "Forward-Looking Statements” as that term is used in applicable securities law. All statements included herein, other than statements of historical fact, including, without limitation, statements regarding the Study, the assumptions and pricing contained in the Study, the economic analysis contained in the Study, the results of the Study, the development of the Hopes Advance project, mineral resources at the Project, the closing of the Offerings, the size of the Non-Brokered Offering; the timing of the Closing Date; the intended use of proceeds of the Offerings; the exercise of the Underwriters’ Option; regulatory approval of the Offerings; the and future plans and objectives of Oceanic are forward-looking statements that involve various risks and uncertainties. In certain cases, forward-looking statements can be identified by the use of words such as "plans”, "expects” or "does not expect”, "scheduled”, "objective”, "believes”, "assumes”, "likely”, or variations of such words and phrases or statements that certain actions, events or results "potentially”, "may”, "could”, "would”, "should”, "might” or "will” be taken, occur or be achieved. There can be no assurance that such statements will prove to be accurate, and actual results could differ materially from those expressed or implied by such statements. Forward-looking statements are based on certain assumptions that management believes are reasonable at the time they are made. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including, but not limited to, the assumption that: (1) there being no significant disruptions affecting operations, whether due to labour/supply disruptions, damage to equipment or otherwise; (2) permitting, development, expansion and power supply proceeding on a basis consistent with the Company’s current expectations; (3) certain price assumptions for iron ore; (4) prices for availability of natural gas, fuel oil, electricity, parts and equipment and other key supplies remaining consistent with current levels; (5) the accuracy of current mineral resource estimates on the Company’s property; (6) labour and material costs increasing on a basis consistent with the Company’s current expectations; (7) the closing of the Offerings on the anticipated terms or at all, and the Company using the net proceeds of the Offerings as anticipated. Important factors that could cause actual results to differ materially from the Company’s expectations are disclosed under the heading "Risks and Uncertainties” in the Company’s most recently filed MD&A (a copy of which is publicly available on SEDAR+ at www.sedarplus.ca under the Company’s profile) and elsewhere in documents filed from time to time, including MD&A, with the TSX Venture Exchange and other regulatory authorities. Such factors include, among others, risks related to the ability of the Company to obtain necessary financing and adequate insurance; the ability of the Company to secure a partner for the Project; the economy generally; fluctuations in the currency markets; fluctuations in the spot and forward price of iron ore or certain other commodities (e.g., diesel fuel and electricity); changes in interest rates; disruption to the credit markets and delays in obtaining financing; the possibility of cost overruns or unanticipated expenses; employee relations; the closing of the Offerings on the anticipated timing, or at all; and the Company raising less than the maximum amount of gross proceeds of the Offerings. Accordingly, readers are advised not to place undue reliance on Forward-Looking Statements. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise Forward-Looking Statements, whether as a result of new information, future events or otherwise. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Over the past years, the author of the cURL project, [Daniel Stenberg], has repeatedly complained about the increasingly poor quality of bug reports filed due to LLM chatbot-induced confabulations, also ...read more

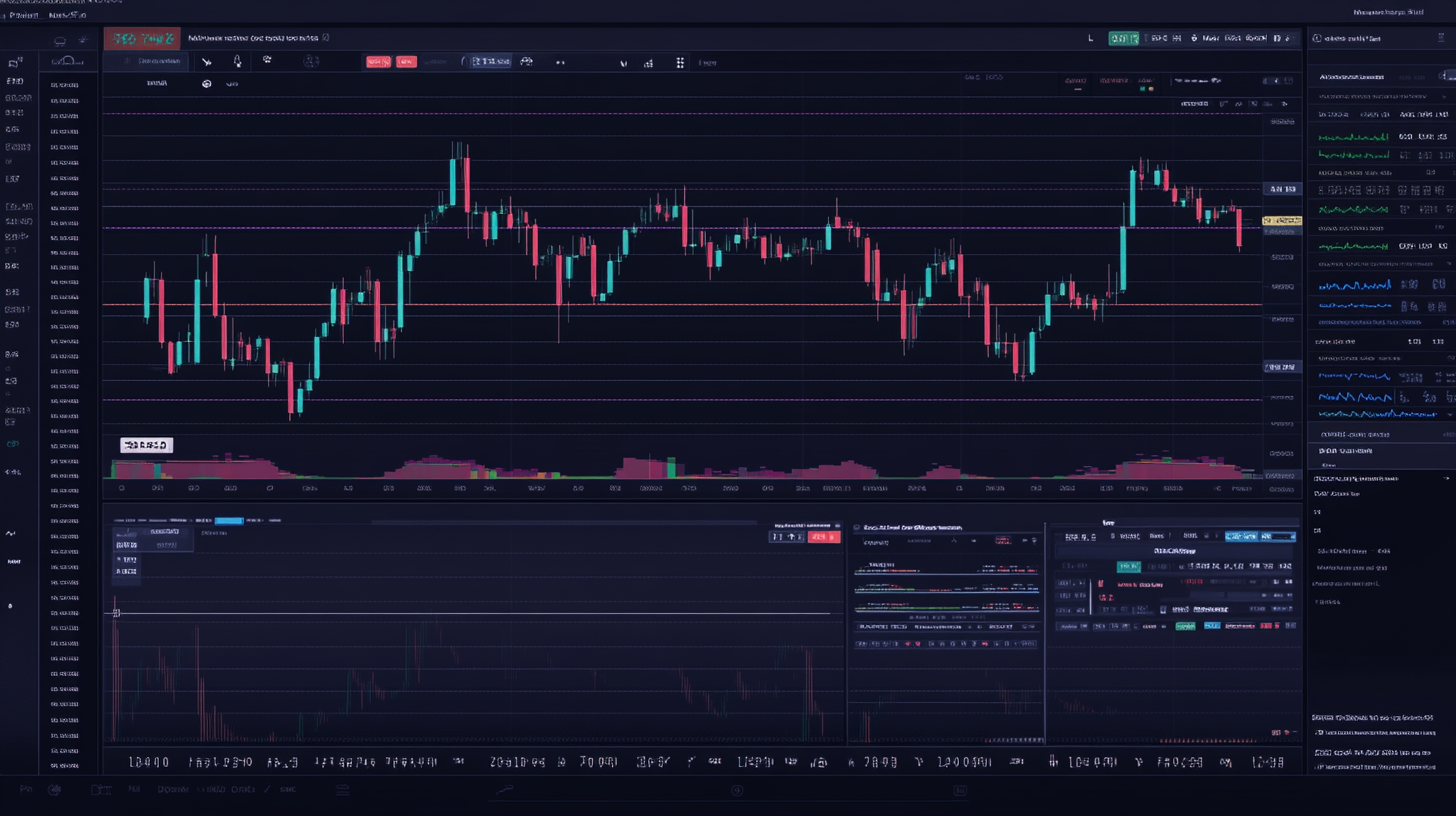

Explore Rápido Vexalith – offering real-time data, automated trading, and more. Discover if it's trustworthy now!

THE COUNCIL are set to host a live online public webinar this week to share the latest updates on the A38 Bromsgrove Route Enhancement Programme (BREP).

As India heads into Budget season ahead of the Union Budget presentation on February 1, terms like fiscal deficit and revenue deficit dominate discussions but often confuse common people.The post Union Budget 2026: What is Fiscal Deficit and Revenue Deficit and why do they matter? They are important in budget due to... appeared first on News24.

The new legislation expands the workforce, strengthens the economy, and improves public safety and workforce reliability. Also, an independent streak grows, a libertarian weighs in, Trump needs trophies, and Illinois must keep the Bears.

An Essex company which went through the ‘incredibly rigorous’ process to earn a coveted corporate certificate has shared why it was worth it.

TORONTO, Jan. 26, 2026 /CNW/ - Bravo Mining Corp. (TSXV:BRVO) (OTCQX:BRVMF) ("Bravo" or the "Company") welcomes the publication of Presidential Decree No. 12,823, signed on January 22, 2026, by President Luiz Inácio Lula da Silva, which formally creates the Export Processing Zone of Barcarena (ZPE Barcarena) in the Municipality of Barcarena, State of Pará. The Decree was published on January 23, 2026 in the Diário Oficial da União, Brazil's Federal Gazette. Link here: DECRETO No 12.823The decree represents the final federal act establishing the ZPE, following its prior approval by Brazil's National Council of Export Processing Zones (CZPE). As previously announced on November 5, 2025, Bravo has been selected to anchor the ZPE Barcarena, becoming the first mineral project ever designated as an anchor tenant of a Brazilian ZPE.In this context, the publication of the Presidential Decree strengthens Bravo's Alternate Case development scenario as such detailed in our Preliminary Economic Assessment ("PEA", see press release dated on July 7, 2025), which contemplates the use of the ZPE Barcarena fiscal framework to enable local processing and vertical integration of metals potentially produced from the Luanga palladium + platinum + rhodium + gold + nickel project ("Luanga Project" or "Luanga PGM+Au+Ni Project").The formal creation of the ZPE enhances regulatory certainty around this complementary pathway and reinforces the strategic alignment of the Company's potential development plans with Brazil's national industrial policy and Pará's economic development agenda.The initiative was led by the Government of the State of Pará, through the Secretariat of Economic Development, Mining and Energy (SEDEME) and the Economic Development Company of Pará (CODEC), in partnership with Bravo, and in coordination with the Brazil's Ministry of Mines and Energy (MME), Federation of Industries of Pará (FIEPA), the State Secretariat for the Environment of Pará (SEMA), and the Municipality of Barcarena."The signing of the Presidential Decree formally creating the ZPE Barcarena is a significant milestone for Bravo and materially advances regulatory certainty around our development scenario," said Luís Azevedo, Chairman and CEO of Bravo. "Coming on the heels of the recent closing of our oversubscribed equity financing for net proceeds of ~C$81.8 million, completed amid strong investor demand and an improving PGM price environment, with the 4PGE* basket price now approximately 60% higher than the price used in our PEA, this development further reinforces our confidence in the long-term strategic positioning of the Luanga Project. Together, these milestones highlight both the strength of our asset and the growing alignment between Bravo's development strategy and Brazil's industrial and economic objectives".*4PGE = Platinum, Palladium, Rhodium and GoldBarcarena Export Processing Zone (ZPE)As detailed in the Company's press release dated November 5, 2025, ...Full story available on Benzinga.com

VANCOUVER, British Columbia, Jan. 26, 2026 (GLOBE NEWSWIRE) -- UNITED LITHIUM CORP. (“United” or the “Company”) (CSE: ULTH; OTCQX: ULTHF; FWB: 0UL) is pleased to announce that it has acquired all of the issued and outstanding shares of Swedish Minerals AB (“SM” or “Swedish Minerals”), an arm’s length Swedish corporation, for total consideration of approximately $3,600,500 (the “Transaction”), in accordance with the share exchange agreement dated December 10, 2025 (the “Agreement”) among United, SM and the shareholders of SM (the “SM Shareholders”). The acquisition significantly expands United’s Nordic strategic metals platform through the addition of a large uranium and rare earth exploration portfolio in Finland and Sweden.

As an operative researcher for luxury retail companies, I spent my career grabbing onto one corporate contract after the next, like a tree-swinging retainer monkey. But in a tariff-distressed industry, those contract “branches” grew further and further apart until I was left hanging. Then a colleague experiencing a similar work gap said, “Well, I guess we’re retired.”I’ve been called a lot of things in my life, but nothing prepared me for the word “retired.” I’m a freelancer, so no one is coming to my house with a gold watch as a reward for loyal service; I have no desire to move south; and I don’t play golf. My equally self-employed friend Roland had a suggestion: Why not consider myself “situationally” retired—that is, retired until the phone rings.It’s funny how one word can make or break your spirit. I was crushed by “retired” because the concept is foreign and frightening. But adding “situational” made it comfortingly familiar. After all, for us freelancers every corporate contract is situational; you might even say that situational is my superpower.A friend who’s spent decades in a grueling C-suite position still can’t bring himself to retire, despite vested stock and a strong financial footing. Happy or not, he remains in the grip of his job, unable to let go of a role he believes defines (and so ultimately confines) him.I’ve been an outside observer of corporate America long enough to understand his struggle, although it is not my own.Redirecting your energyAs an independent contractor working for different companies, each with its own ecosystem, I constantly adapted my work persona to fit each unique corporate culture. Fluidity is what stabilized my career and so the loss of a fixed identity was not my retirement problem. My issue was displaced energy.Whether writing a history of plaid for a fashion CEO or helping the VP of design at a boutique hotel chain find just the right urban neighborhoods for expansion, every project required a tremendous amount of advance work.From sleuthing out relevant reference resources to searching for subject-specific experts, my research work was as fascinating as it was fun. I rarely left my desk yet built a national network of specialists and accumulated wide-ranging knowledge that often dovetailed, making every project a little easier. When the work slowed—and then stopped—my detective skills had nowhere to go.I can’t remember how long I was in that uncomfortable standstill until Roland’s use of the word “situational” got me moving. To kick off “Project Retirement,” I went on my usual research prowl.Every day, about 11,400 Americans turn 65—the traditional retirement milestone—fueling a busy and lucrative media market spanning content, publishing, and podcasts. But the most valuable operative research is not about finding the most information. It requires you to find the right information—information that is directional, that you can build upon, that can help steer your project to a successful conclusion.Redefining retirementFor me, the initial guiding principles came from the YouTube channel Small Retired Life and Raina Vitanov’s practical yet inspirational attitude. Her conversation about being rebellious enough to redefine and rebrand retirement broadened my understanding and freed me to choose my own norms and values. But the most significant contribution was her observation that in retirement, “Productivity is not the conversation.” Using the Roland method, I added a word and had a revelation: Transactional productivity is no longer my conversation.The time between contracts used to feel borrowed; now I own it. And all that research joie de vivre that I enjoyed over my corporate years is mine to use as I like. Sit next to me if you want to talk about the architecture of Shaker communities, art in ’80s New York, or the difference between Ivy style and preppy fashion.I also started a side gig in a small boutique where I once shopped whenever I needed to outfit myself for a rare visit into corporate America. Because I’ve never had a structured straight job, I find the work to be fresh and interesting. It’s also rewarding because I get to use decades of style research on real live women, many playing out their own life-shifting issues through the lens of their wardrobes.Although I’m not sure I can pull off being an introvert cosplaying as an extrovert for more than my customary two workdays a week, I might give it a shot. Because now that I’ve got the hang of it, situational retirement can be whatever I want it to be.

Vancouver, BC, Canada, Jan. 26, 2026 (GLOBE NEWSWIRE) -- WestKam Gold Corp. (TSXV:WKG) (the “Company” or “WestKam”) announces that further to its news release of January 23, 2026, it has received overwhelming interest above the previously announced non-brokered private placement offering of up to $300,000. Accordingly, the Company is increasing this offering such that it now proposes to sell up to 7,142,857 units (the “Units”) at a price of $0.07 per Unit to raise total gross proceeds of up to $500,000 (the “Offering”). Each Unit will consist of one common share of the Company and one common share purchase warrant. Each warrant will be exercisable for one common share at a price of $0.10 for a period of three years. The proceeds received from the sale of the Units will be used to pay outstanding trade payables, legal fees, audit fees, transfer agent fees and for general working capital.