Hyve Solutions Announces Leadership Transition

FREMONT, Calif.--(BUSINESS WIRE)--Hyve Solutions announces leadership transition.

FREMONT, Calif.--(BUSINESS WIRE)--Hyve Solutions announces leadership transition.

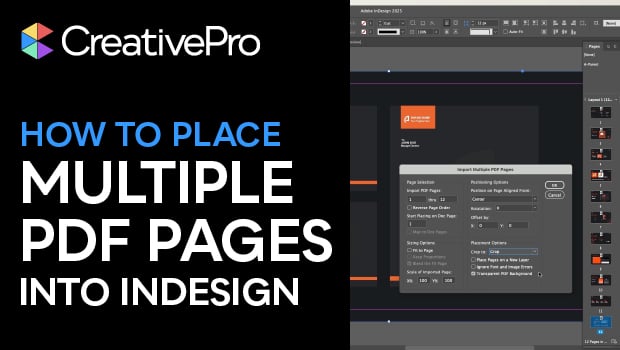

Learn how to place multiple pages of a PDF into InDesign with a few free scripts.The post How to Quickly Place Multiple PDF Pages in InDesign first appeared on CreativePro Network.

SAN DIEGO, Jan. 27, 2026 /PRNewswire/ -- Robbins LLP reminds stockholders that a class action was filed on behalf of all investors who purchased or otherwise acquired Bitdeer Technologies Group (NASDAQ: BTDR) securities between June 6, 2024 and November 10, 2025. Bitdeer is a Bitcoin...

Blockchain analytics firm Chainalysis has released a new report highlighting a sharp escalation in crypto-based money laundering, warning that Chinese-language money laundering networks are emerging as one of the most serious and rapidly growing threats in the digital asset ecosystem. The Rise of Chinese‐Language Networks In Crypto Crime According to the report, illicit on‐chain money laundering activity has expanded dramatically over the past five years. In 2020, crypto-related laundering was estimated to be around $10 billion. By 2025, that figure had climbed to more than $82 billion. A key driver behind this growth has been the rapid rise of Chinese‐language money laundering networks, often referred to as CMLNs. In 2025, these networks accounted for roughly 20% of all identified illicit crypto laundering activity on‐chain. Related Reading: XRP Outlook For 2026: AI Model Signals New Record Ahead — Can Price Reach $6? Chainalysis noted that this regional concentration is further supported by off‐ramping behavior observed on the blockchain. As detailed in the report, CMLNs now routinely launder more than 10% of funds stolen through so‐called “pig butchering” scams. The pace at which these networks have grown stands out even within the broader crypto crime landscape. Since 2020, inflows to identified CMLNs have increased 7,325 times faster than those to centralized exchanges (CEXs). Growth has also outstripped other laundering channels, expanding 1,810 times faster than decentralized finance (DeFi) platforms and 2,190 times faster than illicit on‐chain flows that remain within criminal ecosystems. While CMLNs are not the only actors involved in crypto laundering, Chainalysis found that Chinese‐language, Telegram‐based services now represent a disproportionately large share of attributed global laundering activity. Cross‐Border Crime At Scale The report also shows that CMLNs function openly across multiple platforms and rely on complex, multi‐layered systems. Their operations are characterized by industrial‐level processing capacity and a high degree of technical sophistication. In 2025 alone, Chainalysis identified six distinct service types that together form the CMLN ecosystem. Combined, these services processed $16.1 billion in illicit inflows during the year. The number of active entities within these networks has also grown rapidly, expanding from a small number of wallets just a few years ago to more than 1,799 active on‐chain wallets in 2025. Related Reading: Tether Reveals Massive Gold Accumulation In Q4: Adds 27 Tons To Reserves Tom Keatinge, Director at the Centre for Finance & Security at the Royal United Services Institute, said the speed and scale of these networks are the result of converging global forces. He noted that Chinese money laundering networks have rapidly evolved into “multi‐billion‐dollar cross‐border operations” offering efficient and competitively priced services to organized crime groups across Europe and North America. Chris Urben, Managing Director at Nardello & Co, highlighted another major shift within these networks. He explained that Chinese money laundering groups have increasingly moved away from informal value transfer systems, such as traditional underground banking methods. Instead, Urben emphasized that these criminals have embraced cryptocurrencies as a “faster and more discreet way” to move funds across borders, eliminating the need for complex manual ledgers spread across multiple jurisdictions. Featured image from DALL-E, chart from TradingView.com

Silver (XAG) Forecast: Silver Rally Overheated—Where Real Value Lies FXEmpireSilver jumps almost 6%, gold breaks beyond $5,100: What is driving precious metals? Times of IndiaWhy is silver price looking to hit $150 soon and will it go on to touch $170 milestone? Silver price outlo The Economic TimesGold-silver ratio slumps sharply: What does it signal for investors? Explained MintSilver Rises On Strong Demand, Refining Constraints And Ongoing Supply Shortage Concerns By Kedia Advisory Investing.com India

West African Resources boosted cash reserves in the December quarter, underlining strong operations and ongoing investment in its gold projects.The post West African Resources posts strong December quarter cash inflows appeared first on The Motley Fool Australia.

Barrick Mining Corp (NYSE:B) easily ranks among the hottest securities in the gold market, having gained 18% since the start of January. Additionally, over the past 52 weeks, B stock skyrocketed to the tune of 220%. Still, with so much enthusiasm baked into the security, the immediate concern is that a corrective lull may transpire. Those who are aggressive can use options to scalp some profits on this possible downside.To clarify, the long-term narrative for Barrick stock appears robustly bullish. Fundamentally, one of the biggest catalysts of the precious metals complex is demand from central banks. According to the World Gold Council, this institutional acquisition has now averaged roughly 60 tons per month, more than triple the pre-2022 pace. Combined with industrial (particularly tech sector) demand for silver and other important commodities, the overall framework is compelling.Still, the equities market is non-ergodic, meaning that even though the longer-term performance may be positive, the chart can temporarily be punctuated by negative price action. This non-ergodicity is best expressed in the options market, where traders effectively buy insurance against either downside or upside risk.In the case of B stock, exposure to the bullish narrative is clearly overcrowded. We're talking about a security that has gained over 140% in the past six months. Because of this rally, bullish conviction is no longer the dominant theme in the options market.Looking at volatility skew — a screener that identifies implied volatility (IV) or the target stock's expected kinetic outlook — put option IV is mostly priced higher than call IV across the strike price spectrum for the Feb. 20 expiration date. That's an obvious signal that smart money is prioritizing downside protection by effectively buying volatility insurance and also being synthetically short B stock to protect the underlying holdings' value.Of course, the smart money isn't automatically ...Full story available on Benzinga.com

The AUD/JPY currency pair stabilizes after a pullback, influenced by intervention speculation and a bullish but flattening RSI. The analysis highlights key technical levels, including potential resistance at 107.59 and support at 105.00. The report also details the relative performance of the Australian Dollar against other major currencies, providing a comprehensive market overview.

The new store is part of a 'revitalization of the Rollins Crossing Shopping Center.

Sam Malinski’s breakout season has made him a very wealthy man.

Market Analysis by covering: Qualcomm Incorporated. Read 's Market Analysis on Investing.com