Newcastle Airport seeks further expansion following record passenger growth

Newcastle Airport seeks government co-investment in new flight routes.

Newcastle Airport seeks government co-investment in new flight routes.

Both companies operate platforms that can keep growing even when conditions aren’t perfect.The post 2 Australian stocks I would buy in 2026 appeared first on The Motley Fool Australia.

Venezuela’s acting president signs oil industry overhaul, easing state control to lure investors

SINGAPORE: Stocks were volatile in early Asian trading on Friday after US President Donald Trump endorsed a bipartisan deal to avert a fresh government shutdown and said he has decided who he will nominate to lead the Federal Reserve.MSCI’s broadest index of Asia-Pacific shares outside Japan fluctuated between gains and losses and was recently down 0.2%, extending the previous day’s declines as it headed for its best monthly performance in more than three years.S&P 500 e-mini futures slid 0.4% and Nasdaq e-mini futures were off 0.5%, while precious metals were choppy after a flash crash.“Progress toward averting a shutdown would reinforce U.S. yields and the dollar, while heightened shutdown risk would shift markets to headline-driven moves amid possible data delays,” said Shoki Omori, chief desk strategist for rates and FX at Mizuho in Tokyo.On Thursday, Wall Street stocks fell after lacklustre earnings from Microsoft raised fears about whether its bets on artificial intelligence would pay off. The S&P 500 closed down 0.1% and the Nasdaq Composite tumbled 0.7%.“There was plenty of drama in the markets,” analysts from Westpac wrote in a research report. “Sentiment shifted during U.S. trading hours when concerns about equity valuations in the technology sector resurfaced.”With just under a third of S&P 500 companies having reported, 76% of companies have beaten earnings estimates. But earnings season has thus far been a mixed bag for the major U.S. tech firms that dominate the index.Microsoft’s shares dropped 10% on Thursday, shredding more than $350 billion in market value after its cloud business failed to impress, while Meta gained 10% as its AI investments bolstered ad targeting, aiding a rosy first-quarter forecast.Meanwhile, Apple on Thursday forecast a surge of up to 16% in revenue for the March quarter, well ahead of Wall Street’s expectations, powered by strong demand for its iPhones and a sharp rebound in China.In Japan, the Nikkei 225 was flat after data on Friday showed that core consumer prices in Tokyo rose 2.0% in January from a year earlier, slowing from the previous month but matching the Bank of Japan’s target, easing pressure on the central bank.The US dollar index , which measures the greenback’s strength against a basket of six currencies, was last up 0.3% at 96.441 after Trump said he would unveil his pick to replace Federal Reserve Chair Jerome Powell on Friday.On prediction market site Polymarket, the implied probability of contracts betting that Trump will nominate former Fed Governor Kevin Warsh to lead the central bank surged to 88%.The yield on the U.S. 10-year Treasury bond was last up 3.8 basis points at 4.263%. Fed funds futures are pricing an implied 86.6% probability that the US central bank will hold steady on rates at its next two-day meeting on March 18, compared with a 87.5% chance a day earlier, according to the CME Group’s FedWatch tool. A faltering rebound for precious metals fell short after a choppy session on Thursday.Gold was last down 0.7% at $5,357.9404, while silver slipped 0.2% to $115.89.“The liquidation of what had become some grossly extended positioning ... is not overly surprising, particularly in the precious metals space,” said Chris Weston, head of research at Pepperstone Group in Melbourne.WTI crude was last down 0.7% at $64.95 as oil markets weighed geopolitical risks, after Trump on Thursday signed an executive order declaring a national emergency and establishing a process to impose tariffs on goods from countries that sell or provide oil to Cuba.Also Thursday, Trump said he was planning to talk to Iran amid rising tensions. Bitcoin was last down 2.0% at $82,684.51, while ether = was last down 1.7% at $2,768.01.

RWS ‘better positioned’ to win back high-rollers from MBS: DBS The Business TimesDBS keeps 'hold' call and 80 cents target price on Genting SG under review The Edge SingaporeGenting Singapore stock pops as brokers flag high-roller fight — eyes on Feb 24 results TechStock2Singapore Market Roundup (29-Jan-2026): DBS holds 'hold' rating, targets Genting SG at 80 cents. SmartkarmaWill Genting Singapore's (SGX:G13) 100% Payout Ratio Ahead of 2026 Results Change Its Investment Narrative? simplywall.st

The plan, issued by the General Office of the State Council, aims to enhance and expand the supply of consumer services while grasping the trend of consumption upgrading in the sector.

Trump Reportedly To Announce Kevin Warsh Next Fed Chair Friday Morning; Bitcoin, Gold Tumble, Dollar Soars It all started a little after 7pm ET when, refuting a previous report that he would announce the next Fed Chair next week, Trump said that he would unveil his pick for Powell's replacement...

Shares slipped Friday in Asia after a day of dramatic swings on Wall Street that included Microsoft’s worst drop in nearly six years. Oil prices fell more than $1 and the prices of gold and silver weakened. Tokyo’s Nikkei 225 shed 0.5% to 53,119.18 as stocks related to artificial intelligence declined. Testing equipment maker Advantest [...]

Has Coles outshone Woolies when it comes to dividends?The post Buying Coles stock? Here's the dividend yield you'll get appeared first on The Motley Fool Australia.

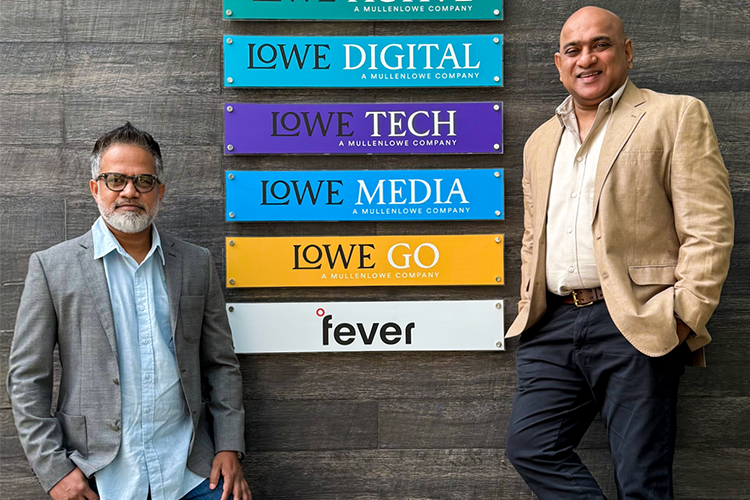

The MullenLowe Group (MLG) Sri Lanka announced the appointment of Harendra Uyanage as Chief Creative Officer (CCO), further strengthening the Group’s creative leadership as it continues to shape culture-led, business-driving brand thinking across categories.Harendra’s appointment recognises a career built on strategic creativity, filmmaking excellence, and an ability to redefine how legacy and emerging brands engage with contemporary audiences. Over more than two decades, he has led transformative work across personal care, home care, beauty, healthcare, financial services, telecommunications, and retail, consistently delivering creativity that drives both cultural relevance and commercial impact.Widely regarded as one of Sri Lanka’s most decorated creative leaders, Harendra has played a pivotal role in steering the agency’s creative reputation locally and regionally. His leadership has contributed to multiple Effie wins across categories, including Gold and Silver accolades in recent years, and to the agency being recognised among Asia Pacific’s most effective creative organisations. Several brand revivals under his direction have gone on to become long-term business success stories, reinforcing the value of insight-led creativity and disciplined storytelling.Commenting on the appointment, Thayalan Bartlett, Executive Chairman of the MullenLowe Group Sri Lanka said, “From a paste-up artist to the C-suite and boardroom of Sri Lanka’s largest brand communications company, Harendra’s journey exemplifies perseverance, humility, and uncompromising creative conviction. At a time when integrity in our industry is under increasing scrutiny, he has been central to building MullenLowe Sri Lanka’s creative reputation on deep routed values and inspiring a generation of talent. As Chief Creative Officer, he will continue to set high standards for our work, our people, and for creativity.”Beyond campaign work, Harendra has been instrumental in shaping industry standards through mentoring and jury roles at leading local and regional award platforms. His commitment to developing young creative talent remains central to his leadership philosophy, reflecting a belief that sustainable creative excellence is built by nurturing people as much as ideas.Harendra was also the first-ever recipient of the Next Generation Leader Scholarship, a landmark industry initiative that recognises future-facing leadership and provides exposure to global creative benchmarks. The recognition reinforces his standing as a leader equipped to carry Sri Lankan creativity onto the world stage while strengthening the industry at home.Speaking on his appointment, Harendra Uyanage said, “This role carries both responsibility and purpose. Creativity has the power to influence culture, shift behaviour, and build brands that matter. I look forward to continuing this journey with the team at MullenLowe, mentoring the next generation, and ensuring Sri Lanka is recognised not just for participation, but for leadership in the global creative landscape.”As Chief Creative Officer, Harendra will lead MLG Sri Lanka’s creative vision, strengthening integrated storytelling, craft excellence, and talent development across the Group’s diverse client portfolio.MullenLowe Group Sri Lanka (MLG) is Sri Lanka’s largest integrated brand communications company and operates eight independent strategic business verticals, spanning Mainstream, Digital, Activations, MarTech, Media and Public Relations. MLG’s Sri Lanka office consists of 110 staff, serves 43 of the nation’s top corporates, manages 111 brands across 33 categories, including 80% of the top 10 and 50% of the top 20 most advertised categories in the country making it a company with prolific cross category knowledge. Ranked among the world’s top 100 agencies and APAC’s top 20, MLG is Sri Lanka’s Effie Agency of The Year and a consistent local awards leader for over a decade. It operates as a full member affiliate of MullenLowe Worldwide recently merged with Omnicom combining unmatched global knowledge and experience with local insight to deliver end-to-end brand solutions. Photo Caption: From left: Harendra Uyanage, Chief Creative Officer and Thayalan Bartlett, Executive Chairman of the MullenLowe Group Sri Lanka

TOKYO: The dollar rose on Friday, paring its weekly slide, after U.S. President Donald Trump said he would soon announce his nominee to head the Federal Reserve and on optimism Washington will avert a government shutdown.Trump said he intends to name his pick to replace Fed Chair Jerome Powell on Friday, following reports that former Fed Governor Kevin Warsh visited the White House. In Japan, data showed inflation slowed in Tokyo but matched the central bank’s target.The greenback clawed back some losses from this week as tensions between Trump and Cuba, Iran, Venezuela, Greenland and Europe caused some investors to lose confidence in U.S. assets.“The appointment of Warsh, if it’s true, will be seen as someone who can, in a way, remain independent, and not someone seen as likely to be subservient to Trump’s wishes,” said Khoon Goh, head of Asia research for ANZ in Singapore.“Any sensible market participant would not want to carry a big position into the weekend,” he added. “So some of this could just be positioning lightening up. If you’re short dollars, you’ve done well, take your chips off the table.”The dollar index , which measures the greenback against a basket of currencies, rose 0.4% to 96.60, trimming its weekly decline to 0.9%.Against the Swiss franc , the dollar strengthened 0.7% to 0.7699.The euro sank 0.4% at $1.1916, while the yen weakened 0.42% to 153.77 per dollar. Sterling weakened 0.32% to $1.3759.Warsh came to the White House for a meeting with Trump on Thursday, according to one source familiar with the matter. A second source said Warsh impressed Trump, who is vetting candidates to replace Powell when his term is up in May.Meanwhile, the White House said that Trump signed an executive order that would impose tariffs on countries that provide oil to Cuba. Reports that Trump is considering strikes against Iran prompted a surge in oil prices and weighed on the dollar earlier.The US domestic front got a glimmer of hope after Trump endorsed a spending deal negotiated by U.S. Senate Republicans and Democrats that would stave off a government shutdown.The dollar hit a four-year low earlier in the week after Trump seemed to shrug off the currency’s weakness, recovering slightly after Treasury Secretary Scott Bessent said that Washington has a strong-dollar policy.The greenback ended last week with its biggest fall since last April, driven partly by concerns about U.S. policy over Greenland.The dollar found some support after the Fed held interest rates steady on Wednesday against the backdrop of what the Fed’s Powell described as a solid economy and diminished risks to both inflation and employment.The dollar slide has provided some reprieve for the battered yen. The Japanese currency has tracked around the 152 to 154 per dollar range for most of this week thanks to talk of rate checks from the U.S. and Japan last week - a move often seen as a precursor to intervention.Core consumer prices in Tokyo rose 2% in January from a year earlier, data showed on Friday, slowing from the previous month but matching the central bank’s target.The Australian dollar weakened 0.7% versus the greenback to $0.6996. New Zealand’s kiwi weakened 0.5% to $0.6045.Cryptocurrencies slumped sharply, with bitcoin sinking 3.3% to $81,619.01, and ether losing 3.4% to $2,719.87.

Store of value? Perhaps not.The post Is Bitcoin digital gold? It seems investors prefer the real thing appeared first on The Motley Fool Australia.